Investing Principles

It is often said that the best things in life come in small packages. However, as it relates to investing in common stocks, it seems to be widely held that bigger is better. But, if a high total return is your objective, you might want to consider that the bigger a company gets, the harder it is for it to grow fast. This is important, because if you invest in a stock at a reasonable valuation, your ultimate long-term returns will be a function of how fast the company grows.

Consequently, size matters if you’re looking for long-term above-average growth. In this regard, j2 Global with a market cap just under $4 billion has plenty of room to continue to grow. Although it could be argued that there is greater safety in larger companies, safety often comes with a price. When investing in common stocks, that price typically comes at the expense of a lower future total potential return. On the other hand, j2 Global’s small size might partially explain why it is under followed and often overlooked in spite of its incredible long-term track record of earnings growth and more recently dividend growth. As the title of this article indicates, it might be a mistake to overlook this attractive growing business just because of its smaller size.

So yes, I will acknowledge that there might be a little more risk investing in a company like j2 Global in contrast to investing in its larger peers such as Microsoft Corporation (NASDAQ:MSFT) or Oracle Corporation (NYSE:ORCL). However, it can also be argued that the future growth potential of these larger companies is behind them, whereas much of j2 Global’s future growth may possibly be still ahead of them.

J2 Global A Fundamental Snapshot Analysis

Now that I discussed what J2 Global Inc (NASDAQ:JCOM) does and how it grows, it is time to take a deeper look into the company’s fundamentals, its long-term growth history and most importantly, j2 Global’s potential for future growth. Let’s start by looking at their historical accomplishments.

As an investor, I tend to admire companies that have strung together a consistent record of earnings and cash flow growth. I believe this provides insights into the attractiveness of the company’s business as well as the competency of its management team. Consistent long-term above-average growth is rarely an accident. Although history does not guarantee the future, I would rather commit to a company with a great track record over a company with weak or sporadic historical results. j2 Global has put together a very impressive record of historical growth and operating excellence.

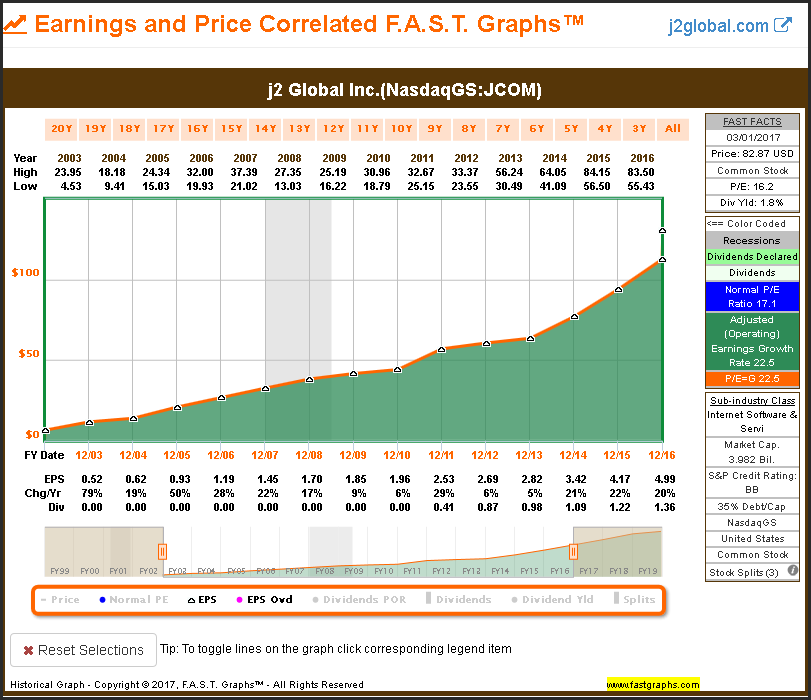

The following F.A.S.T. Graphs™ plots j2 Global’s historical adjusted operating results over the timeframe 12/31/2002 through 12/31/2016. Adjusted operating earnings have grown at a compound annual rate of 22.5% per annum. There are two important aspects of this excellent track record of growth that should be noted. Number one, the incredible reliability and consistency of year-over-year adjusted operating earnings growth has been close to impeccable. Second, there are no forecasts included; this is the actual historical record.

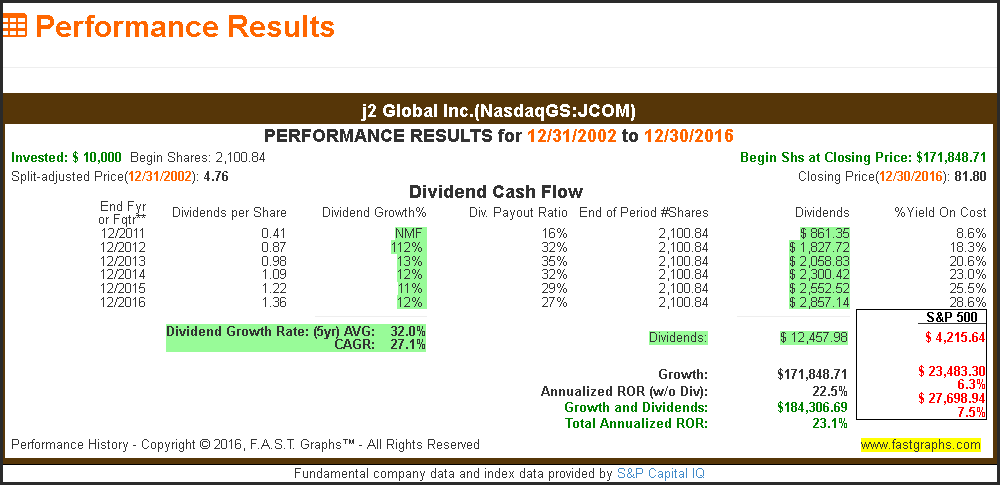

When looking at the company’s performance to shareholders over the above timeframe, it is not a coincidence nor is it an accident that capital appreciation of 22.5% equates to the company’s earnings growth rate achievement. Furthermore (and not shown on the above graph) is the addition of more than $12,000 in dividend income from a one-time initial $10,000 investment.