Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of the third quarter of 2018 as investors first worried over the possible ramifications of rising interest rates and the escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only about 60% S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Zayo Group Holdings Inc (NYSE:ZAYO) and see how the stock is affected by the recent hedge fund activity.

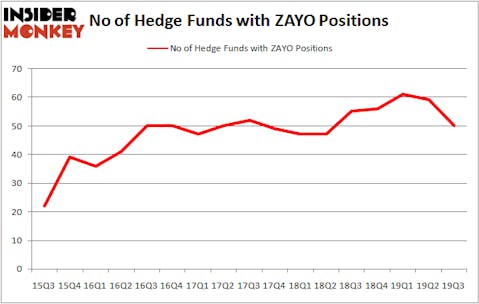

Zayo Group Holdings Inc (NYSE:ZAYO) investors should be aware of a decrease in support from the world’s most elite money managers of late. ZAYO was in 50 hedge funds’ portfolios at the end of the third quarter of 2019. There were 59 hedge funds in our database with ZAYO holdings at the end of the previous quarter. Our calculations also showed that ZAYO isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the new hedge fund action regarding Zayo Group Holdings Inc (NYSE:ZAYO).

How are hedge funds trading Zayo Group Holdings Inc (NYSE:ZAYO)?

At the end of the third quarter, a total of 50 of the hedge funds tracked by Insider Monkey were long this stock, a change of -15% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ZAYO over the last 17 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of Zayo Group Holdings Inc (NYSE:ZAYO), with a stake worth $301.9 million reported as of the end of September. Trailing Citadel Investment Group was Pentwater Capital Management, which amassed a stake valued at $286.3 million. Farallon Capital, TIG Advisors, and Renaissance Technologies were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Twin Capital Management allocated the biggest weight to Zayo Group Holdings Inc (NYSE:ZAYO), around 12.89% of its portfolio. TIG Advisors is also relatively very bullish on the stock, designating 7.53 percent of its 13F equity portfolio to ZAYO.

Since Zayo Group Holdings Inc (NYSE:ZAYO) has faced a decline in interest from the smart money, we can see that there exists a select few hedge funds that decided to sell off their positions entirely last quarter. Interestingly, Steve Cohen’s Point72 Asset Management said goodbye to the biggest position of all the hedgies watched by Insider Monkey, totaling an estimated $54.1 million in stock, and Stuart J. Zimmer’s Zimmer Partners was right behind this move, as the fund cut about $43.6 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest dropped by 9 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Zayo Group Holdings Inc (NYSE:ZAYO). We will take a look at Alaska Air Group, Inc. (NYSE:ALK), Pilgrim’s Pride Corporation (NASDAQ:PPC), ICON Public Limited Company (NASDAQ:ICLR), and Euronet Worldwide, Inc. (NASDAQ:EEFT). All of these stocks’ market caps resemble ZAYO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ALK | 31 | 486037 | 9 |

| PPC | 24 | 264319 | 5 |

| ICLR | 20 | 613069 | 1 |

| EEFT | 35 | 322755 | 2 |

| Average | 27.5 | 421545 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.5 hedge funds with bullish positions and the average amount invested in these stocks was $422 million. That figure was $1997 million in ZAYO’s case. Euronet Worldwide, Inc. (NASDAQ:EEFT) is the most popular stock in this table. On the other hand ICON Public Limited Company (NASDAQ:ICLR) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Zayo Group Holdings Inc (NYSE:ZAYO) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately ZAYO wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ZAYO were disappointed as the stock returned 1.2% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.