The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Xenith Bankshares Inc (NASDAQ:XBKS) .

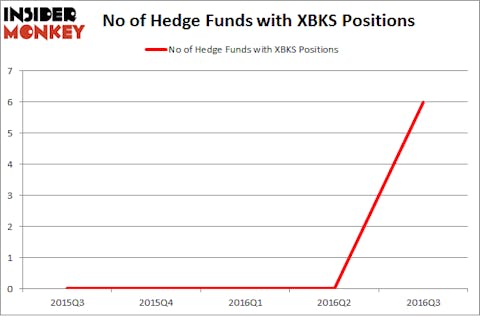

Xenith Bankshares Inc (NASDAQ:XBKS) was in 6 hedge funds’ portfolios at the end of September. XBKS investors should be aware of an increase in hedge fund interest of late since it went public last quarter. At the end of this article we will also compare XBKS to other stocks including RPX Corp (NASDAQ:RPXC), Unifi, Inc. (NYSE:UFI), and AtriCure Inc. (NASDAQ:ATRC) to get a better sense of its popularity.

Follow Xenith Bankshares Inc. (NASDAQ:XBKS)

Follow Xenith Bankshares Inc. (NASDAQ:XBKS)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

qvist/Shutterstock.com

How are hedge funds trading Xenith Bankshares Inc (NASDAQ:XBKS)?

Xenith Bankshares Inc (NASDAQ:XBKS) went public at the end of September and a total of 6 hedge funds amassed shares of the company heading into the fourth quarter. Let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Anchorage Advisors, led by Kevin Michael Ulrich and Anthony Davis, holds the number one position in Xenith Bankshares Inc (NASDAQ:XBKS). Anchorage Advisors has a $97.9 million position in the stock, comprising 10% of its 13F portfolio. The second most bullish fund manager is EJF Capital, led by Emanuel J. Friedman, which holds a $13.9 million position; the fund has 1.1% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions include Jim Simons’ Renaissance Technologies, one of the largest hedge funds in the world, Anton Schutz’s Mendon Capital Advisors and Paul Tudor Jones’s Tudor Investment Corp. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.