It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. The Standard and Poor’s 500 Index returned 7.6% over the 12-month period ending November 21, while more than 51% of the constituents of the index underperformed the benchmark. Hence, a random stock picking process will most likely lead to disappointment. At the same time, the 30 most favored mid-cap stocks by the best performing hedge funds monitored by Insider Monkey generated a return of 18% over the same time span. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Wright Medical Group Inc (NASDAQ:WMGI).

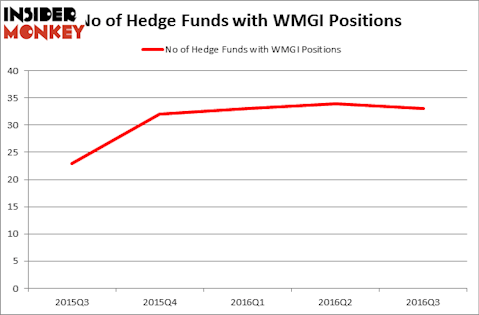

Is Wright Medical Group Inc (NASDAQ:WMGI) a buy right now? Investors who are in the know are turning less bullish. The number of long hedge fund bets (among the funds we track) inched down by one to 33 during the third quarter. At the end of this article we will also compare WMGI to other stocks including Exelixis, Inc. (NASDAQ:EXEL), Northwest Natural Gas Co (NYSE:NWN), and Greif, Inc. (NYSE:GEF) to get a better sense of its popularity.

Follow Wright Medical Group Inc (Old) (NASDAQ:WMGI)

Follow Wright Medical Group Inc (Old) (NASDAQ:WMGI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

g-stockstudio/Shutterstock.com

Keeping this in mind, we’re going to take a gander at the new action surrounding Wright Medical Group Inc (NASDAQ:WMGI).

Hedge fund activity in Wright Medical Group Inc (NASDAQ:WMGI)

Heading into the fourth quarter of 2016, 33 hedge funds tracked by Insider Monkey were long Wright Medical Group, down by 3% over the quarter. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Samuel Isaly’s OrbiMed Advisors has the most valuable position in Wright Medical Group Inc (NASDAQ:WMGI), worth close to $180.4 million, corresponding to 2.1% of its total 13F portfolio. The second most bullish fund manager is Bridger Management, led by Roberto Mignone, which holds a $78.3 million position; the fund has 5.3% of its 13F portfolio invested in the stock. Other peers that are bullish include Ken Fisher’s Fisher Asset Management, William Leland Edwards’ Palo Alto Investors, and Israel Englander’s Millennium Management.

Judging by the fact that Wright Medical Group Inc (NASDAQ:WMGI) has faced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of funds who were dropping their entire stakes during the third quarter. It’s worth mentioning that Stephen DuBois’s Camber Capital Management said goodbye to the largest investment of the “upper crust” of funds watched by Insider Monkey, worth about $43 million in call options.

Let’s now take a look at hedge fund activity in other stocks similar to Wright Medical Group Inc (NASDAQ:WMGI). These stocks are Exelixis, Inc. (NASDAQ:EXEL), Northwest Natural Gas Co (NYSE:NWN), Greif, Inc. (NYSE:GEF), and Tetra Tech, Inc. (NASDAQ:TTEK). This group of stocks’ market caps are closest to WMGI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EXEL | 34 | 505946 | 13 |

| NWN | 12 | 53058 | -2 |

| GEF | 20 | 183000 | -1 |

| TTEK | 18 | 74714 | 1 |

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $204 million at the end of September. That figure was $658 million in WMGI’s case. Exelixis, Inc. (NASDAQ:EXEL) is the most popular stock in this table. On the other hand Northwest Natural Gas Co (NYSE:NWN) is the least popular one with only 12 bullish hedge fund positions. Wright Medical Group Inc (NASDAQ:WMGI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Exelixis, Inc. (NASDAQ:EXEL) might be a better candidate to consider a long position.