Is Winnebago Industries, Inc. (NYSE:WGO) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

Is Winnebago Industries, Inc. (NYSE:WGO) the right pick for your portfolio? Money managers are taking a bearish view. The number of bullish hedge fund positions went down by 2 recently. Our calculations also showed that WGO isn’t among the 30 most popular stocks among hedge funds. WGO was in 15 hedge funds’ portfolios at the end of December. There were 17 hedge funds in our database with WGO holdings at the end of the previous quarter.

To the average investor there are plenty of formulas shareholders use to evaluate publicly traded companies. Two of the less utilized formulas are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the best money managers can outpace their index-focused peers by a very impressive margin (see the details here).

We’re going to take a gander at the latest hedge fund action surrounding Winnebago Industries, Inc. (NYSE:WGO).

Hedge fund activity in Winnebago Industries, Inc. (NYSE:WGO)

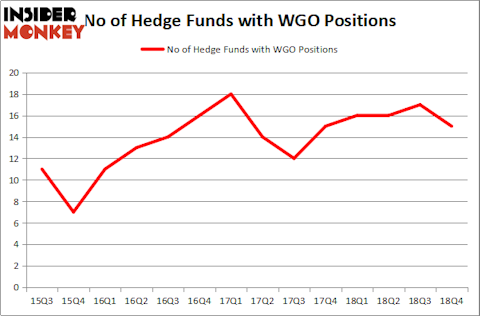

At the end of the fourth quarter, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -12% from the previous quarter. The graph below displays the number of hedge funds with bullish position in WGO over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Winnebago Industries, Inc. (NYSE:WGO) was held by Royce & Associates, which reported holding $32.5 million worth of stock at the end of December. It was followed by Marshall Wace LLP with a $13.9 million position. Other investors bullish on the company included Renaissance Technologies, Tontine Asset Management, and GAMCO Investors.

Judging by the fact that Winnebago Industries, Inc. (NYSE:WGO) has faced falling interest from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of fund managers who sold off their full holdings by the end of the third quarter. Interestingly, Israel Englander’s Millennium Management said goodbye to the biggest stake of the “upper crust” of funds watched by Insider Monkey, valued at about $5 million in stock. Alexander Mitchell’s fund, Scopus Asset Management, also said goodbye to its stock, about $4.8 million worth. These moves are interesting, as aggregate hedge fund interest fell by 2 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Winnebago Industries, Inc. (NYSE:WGO). These stocks are Verso Corporation (NYSE:VRS), QAD Inc. (NASDAQ:QADA), Unit Corporation (NYSE:UNT), and Nexeo Solutions, Inc. (NASDAQ:NXEO). All of these stocks’ market caps are closest to WGO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VRS | 22 | 153046 | 0 |

| QADA | 17 | 122206 | 1 |

| UNT | 15 | 9318 | 5 |

| NXEO | 24 | 368341 | -6 |

| Average | 19.5 | 163228 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $163 million. That figure was $79 million in WGO’s case. Nexeo Solutions, Inc. (NASDAQ:NXEO) is the most popular stock in this table. On the other hand Unit Corporation (NYSE:UNT) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Winnebago Industries, Inc. (NYSE:WGO) is even less popular than UNT. Hedge funds clearly dropped the ball on WGO as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on WGO as the stock returned 50.4% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.