Is Vista Gold Corp. (NYSEAMEX:VGZ) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

Hedge fund interest in Vista Gold Corp. (NYSEAMEX:VGZ) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare VGZ to other stocks including Richardson Electronics, Ltd. (NASDAQ:RELL), Strattec Security Corp. (NASDAQ:STRT), and Natural Health Trends Corp. (NASDAQ:NHTC) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a large number of signals stock market investors can use to grade stocks. Two of the most underrated signals are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the elite money managers can trounce their index-focused peers by a very impressive amount (see the details here).

Jim Simons of RENAISSANCE TECHNOLOGIES

We’re going to check out the latest hedge fund action encompassing Vista Gold Corp. (NYSEAMEX:VGZ).

What have hedge funds been doing with Vista Gold Corp. (NYSEAMEX:VGZ)?

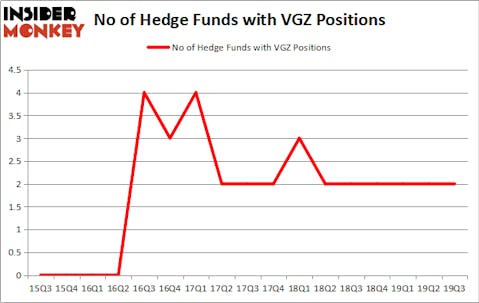

At Q3’s end, a total of 2 of the hedge funds tracked by Insider Monkey were long this stock, the same as one quarter earlier. On the other hand, there were a total of 2 hedge funds with a bullish position in VGZ a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Vista Gold Corp. (NYSEAMEX:VGZ) was held by Sun Valley Gold, which reported holding $14.1 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $0.1 million position.

Judging by the fact that Vista Gold Corp. (NYSEAMEX:VGZ) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there is a sect of hedge funds who sold off their positions entirely by the end of the third quarter. At the top of the heap, Ken Griffin’s Citadel Investment Group cut the biggest investment of the 750 funds tracked by Insider Monkey, worth about $0 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund dropped about $0 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Vista Gold Corp. (NYSEAMEX:VGZ). We will take a look at Richardson Electronics, Ltd. (NASDAQ:RELL), Strattec Security Corp. (NASDAQ:STRT), Natural Health Trends Corp. (NASDAQ:NHTC), and Amtech Systems, Inc. (NASDAQ:ASYS). This group of stocks’ market valuations are closest to VGZ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RELL | 3 | 12199 | 0 |

| STRT | 4 | 12161 | 0 |

| NHTC | 5 | 8269 | -3 |

| ASYS | 7 | 21296 | 0 |

| Average | 4.75 | 13481 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.75 hedge funds with bullish positions and the average amount invested in these stocks was $13 million. That figure was $14 million in VGZ’s case. Amtech Systems, Inc. (NASDAQ:ASYS) is the most popular stock in this table. On the other hand Richardson Electronics, Ltd. (NASDAQ:RELL) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Vista Gold Corp. (NYSEAMEX:VGZ) is even less popular than RELL. Hedge funds dodged a bullet by taking a bearish stance towards VGZ. Our calculations showed that the top 20 most popular hedge fund stocks returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately VGZ wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); VGZ investors were disappointed as the stock returned -22.4% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.