Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first quarter. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Veeva Systems Inc (NYSE:VEEV) to find out whether it was one of their high conviction long-term ideas.

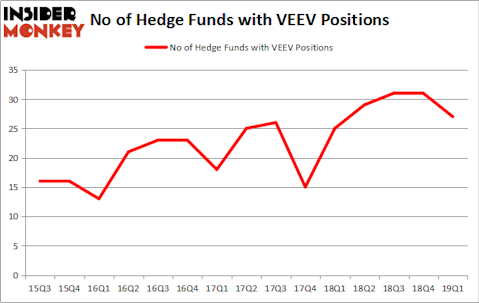

Is Veeva Systems Inc (NYSE:VEEV) a buy, sell, or hold? Hedge funds are becoming less hopeful. The number of long hedge fund positions went down by 4 lately. Our calculations also showed that VEEV isn’t among the 30 most popular stocks among hedge funds. VEEV was in 27 hedge funds’ portfolios at the end of March. There were 31 hedge funds in our database with VEEV holdings at the end of the previous quarter.

In the eyes of most stock holders, hedge funds are assumed to be unimportant, old financial tools of yesteryear. While there are more than 8000 funds in operation at present, Our researchers hone in on the crème de la crème of this group, around 750 funds. It is estimated that this group of investors shepherd the lion’s share of the smart money’s total asset base, and by watching their unrivaled investments, Insider Monkey has unsheathed several investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a gander at the new hedge fund action encompassing Veeva Systems Inc (NYSE:VEEV).

What have hedge funds been doing with Veeva Systems Inc (NYSE:VEEV)?

Heading into the second quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from one quarter earlier. By comparison, 25 hedge funds held shares or bullish call options in VEEV a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, AQR Capital Management, managed by Cliff Asness, holds the biggest position in Veeva Systems Inc (NYSE:VEEV). AQR Capital Management has a $175 million position in the stock, comprising 0.2% of its 13F portfolio. The second most bullish fund manager is Jim Simons of Renaissance Technologies, with a $163.9 million position; 0.1% of its 13F portfolio is allocated to the stock. Other professional money managers that are bullish comprise D. E. Shaw’s D E Shaw, John Overdeck and David Siegel’s Two Sigma Advisors and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Due to the fact that Veeva Systems Inc (NYSE:VEEV) has experienced declining sentiment from the smart money, we can see that there was a specific group of funds who were dropping their entire stakes heading into Q3. It’s worth mentioning that David Goel and Paul Ferri’s Matrix Capital Management dumped the largest stake of the “upper crust” of funds monitored by Insider Monkey, valued at about $58.1 million in stock, and Bruce Garelick’s Garelick Capital Partners was right behind this move, as the fund dumped about $10.4 million worth. These transactions are interesting, as total hedge fund interest was cut by 4 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Veeva Systems Inc (NYSE:VEEV) but similarly valued. We will take a look at Incyte Corporation (NASDAQ:INCY), ORIX Corporation (NYSE:IX), Fastenal Company (NASDAQ:FAST), and Hess Corporation (NYSE:HES). This group of stocks’ market caps are closest to VEEV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INCY | 39 | 3888539 | 5 |

| IX | 6 | 16223 | -1 |

| FAST | 21 | 1144681 | -4 |

| HES | 29 | 1774205 | -7 |

| Average | 23.75 | 1705912 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $1706 million. That figure was $654 million in VEEV’s case. Incyte Corporation (NASDAQ:INCY) is the most popular stock in this table. On the other hand ORIX Corporation (NYSE:IX) is the least popular one with only 6 bullish hedge fund positions. Veeva Systems Inc (NYSE:VEEV) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on VEEV as the stock returned 21.6% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.