Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 817 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about United Rentals, Inc. (NYSE:URI) in this article.

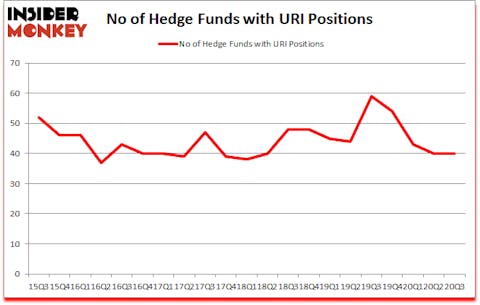

Is URI a good stock to buy now? Hedge fund interest in United Rentals, Inc. (NYSE:URI) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that URI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks). At the end of this article we will also compare URI to other stocks including Hess Corporation (NYSE:HES), Monolithic Power Systems, Inc. (NASDAQ:MPWR), and Cloudflare, Inc. (NYSE:NET) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most shareholders, hedge funds are perceived as unimportant, old financial vehicles of years past. While there are over 8000 funds with their doors open at the moment, Our researchers choose to focus on the bigwigs of this club, approximately 850 funds. It is estimated that this group of investors command most of all hedge funds’ total asset base, and by following their best stock picks, Insider Monkey has revealed many investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to view the latest hedge fund action encompassing United Rentals, Inc. (NYSE:URI).

Do Hedge Funds Think URI Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 40 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 59 hedge funds with a bullish position in URI a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, Lyrical Asset Management held the most valuable stake in United Rentals, Inc. (NYSE:URI), which was worth $315.6 million at the end of the third quarter. On the second spot was Theleme Partners which amassed $182.2 million worth of shares. Arrowstreet Capital, AQR Capital Management, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Theleme Partners allocated the biggest weight to United Rentals, Inc. (NYSE:URI), around 8.37% of its 13F portfolio. Elm Ridge Capital is also relatively very bullish on the stock, designating 6.62 percent of its 13F equity portfolio to URI.

Seeing as United Rentals, Inc. (NYSE:URI) has experienced a decline in interest from the smart money, it’s easy to see that there was a specific group of funds who were dropping their positions entirely in the third quarter. At the top of the heap, Brandon Haley’s Holocene Advisors dropped the largest position of the “upper crust” of funds watched by Insider Monkey, totaling an estimated $46.8 million in stock. Jos Shaver’s fund, Electron Capital Partners, also sold off its stock, about $16 million worth. These moves are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as United Rentals, Inc. (NYSE:URI) but similarly valued. We will take a look at Hess Corporation (NYSE:HES), Monolithic Power Systems, Inc. (NASDAQ:MPWR), Cloudflare, Inc. (NYSE:NET), Cincinnati Financial Corporation (NASDAQ:CINF), KB Financial Group, Inc. (NYSE:KB), Boston Properties, Inc. (NYSE:BXP), and ABIOMED, Inc. (NASDAQ:ABMD). This group of stocks’ market valuations match URI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HES | 35 | 380032 | 7 |

| MPWR | 37 | 753655 | 1 |

| NET | 44 | 541901 | 8 |

| CINF | 19 | 735839 | -1 |

| KB | 6 | 36629 | 0 |

| BXP | 26 | 420101 | -10 |

| ABMD | 25 | 878643 | -6 |

| Average | 27.4 | 535257 | -0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.4 hedge funds with bullish positions and the average amount invested in these stocks was $535 million. That figure was $798 million in URI’s case. Cloudflare, Inc. (NYSE:NET) is the most popular stock in this table. On the other hand KB Financial Group, Inc. (NYSE:KB) is the least popular one with only 6 bullish hedge fund positions. United Rentals, Inc. (NYSE:URI) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for URI is 70.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 30.7% in 2020 through December 14th and still beat the market by 15.8 percentage points. Hedge funds were also right about betting on URI as the stock returned 36.9% since the end of Q3 (through 12/14) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow United Rentals Inc. (NYSE:URI)

Follow United Rentals Inc. (NYSE:URI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.