It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. This was the case with hedge funds, who we heard were pulling money from the market amid the volatility, which included money from small-cap stocks, which they invest in at a higher rate than other investors. This action contributed to the greater decline in these stocks during the tumultuous period. We will study how this market volatility affected their sentiment towards Ubiquiti Networks Inc (NASDAQ:UBNT) during the quarter below.

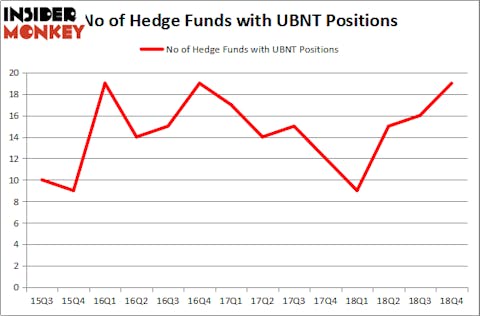

Ubiquiti Networks Inc (NASDAQ:UBNT) has seen an increase in hedge fund interest recently. UBNT was in 19 hedge funds’ portfolios at the end of December. There were 16 hedge funds in our database with UBNT holdings at the end of the previous quarter. Our calculations also showed that UBNT isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a peek at the latest hedge fund action regarding Ubiquiti Networks Inc (NASDAQ:UBNT).

What have hedge funds been doing with Ubiquiti Networks Inc (NASDAQ:UBNT)?

Heading into the first quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 19% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards UBNT over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Akre Capital Management was the largest shareholder of Ubiquiti Networks Inc (NASDAQ:UBNT), with a stake worth $266.4 million reported as of the end of September. Trailing Akre Capital Management was Renaissance Technologies, which amassed a stake valued at $62.8 million. Bandera Partners, Citadel Investment Group, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, specific money managers have been driving this bullishness. Citadel Investment Group, managed by Ken Griffin, created the largest position in Ubiquiti Networks Inc (NASDAQ:UBNT). Citadel Investment Group had $9.6 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also initiated a $2.6 million position during the quarter. The other funds with brand new UBNT positions are Daniel S. Och’s OZ Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Ubiquiti Networks Inc (NASDAQ:UBNT). We will take a look at PVH Corp (NYSE:PVH), Western Gas Partners, LP (NYSE:WES), ICON Public Limited Company (NASDAQ:ICLR), and MGM Growth Properties LLC (NYSE:MGP). This group of stocks’ market values are similar to UBNT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PVH | 35 | 814656 | -9 |

| WES | 6 | 53279 | -2 |

| ICLR | 23 | 461592 | 1 |

| MGP | 12 | 151955 | -3 |

| Average | 19 | 370371 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $370 million. That figure was $388 million in UBNT’s case. PVH Corp (NYSE:PVH) is the most popular stock in this table. On the other hand Western Gas Partners, LP (NYSE:WES) is the least popular one with only 6 bullish hedge fund positions. Ubiquiti Networks Inc (NASDAQ:UBNT) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Nineteen hedge funds were also right about betting on Microsoft as the stock returned 22.6% and outperformed the market as well. You can see the entire list of these shrewd hedge funds here.

Disclosure: None. This article was originally published at Insider Monkey.