In this article we will check out the progression of hedge fund sentiment towards Mammoth Energy Services, Inc. (NASDAQ:TUSK) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

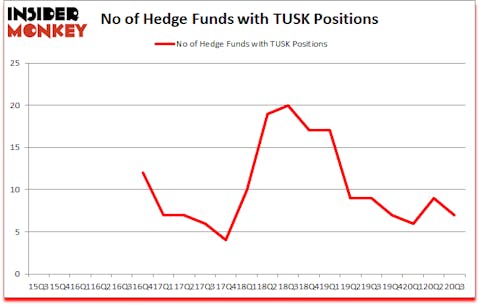

Is TUSK a good stock to buy now? Mammoth Energy Services, Inc. (NASDAQ:TUSK) investors should pay attention to a decrease in enthusiasm from smart money recently. Mammoth Energy Services, Inc. (NASDAQ:TUSK) was in 7 hedge funds’ portfolios at the end of September. The all time high for this statistics is 20. There were 9 hedge funds in our database with TUSK holdings at the end of June. Our calculations also showed that TUSK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 66 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 13% through November 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 5 best cheap stocks to buy according to Ray Dalio to identify stocks with upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s check out the fresh hedge fund action surrounding Mammoth Energy Services, Inc. (NASDAQ:TUSK).

How are hedge funds trading Mammoth Energy Services, Inc. (NASDAQ:TUSK)?

At Q3’s end, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -22% from the second quarter of 2020. Below, you can check out the change in hedge fund sentiment towards TUSK over the last 21 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Wexford Capital was the largest shareholder of Mammoth Energy Services, Inc. (NASDAQ:TUSK), with a stake worth $35.3 million reported as of the end of September. Trailing Wexford Capital was Valueworks LLC, which amassed a stake valued at $5.5 million. Millennium Management, Winton Capital Management, and Two Sigma Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Wexford Capital allocated the biggest weight to Mammoth Energy Services, Inc. (NASDAQ:TUSK), around 9.44% of its 13F portfolio. Valueworks LLC is also relatively very bullish on the stock, earmarking 4.67 percent of its 13F equity portfolio to TUSK.

Because Mammoth Energy Services, Inc. (NASDAQ:TUSK) has faced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there was a specific group of money managers that slashed their positions entirely in the third quarter. It’s worth mentioning that Donald Sussman’s Paloma Partners dumped the largest position of the “upper crust” of funds followed by Insider Monkey, valued at about $0 million in stock, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital was right behind this move, as the fund dropped about $0 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 2 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Mammoth Energy Services, Inc. (NASDAQ:TUSK) but similarly valued. We will take a look at Travelzoo (NASDAQ:TZOO), Entasis Therapeutics Holdings Inc. (NASDAQ:ETTX), Cedar Realty Trust Inc (NYSE:CDR), Epsilon Energy Ltd. (NASDAQ:EPSN), FFBW, Inc. (NASDAQ:FFBW), ASLAN Pharmaceuticals Limited (NASDAQ:ASLN), and Tantech Holdings Ltd. (NASDAQ:TANH). This group of stocks’ market values match TUSK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TZOO | 8 | 7486 | -4 |

| ETTX | 5 | 8357 | 3 |

| CDR | 11 | 4353 | -4 |

| EPSN | 2 | 11939 | -2 |

| FFBW | 3 | 3628 | 1 |

| ASLN | 4 | 3740 | -1 |

| TANH | 3 | 1041 | 1 |

| Average | 5.1 | 5792 | -0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.1 hedge funds with bullish positions and the average amount invested in these stocks was $6 million. That figure was $42 million in TUSK’s case. Cedar Realty Trust Inc (NYSE:CDR) is the most popular stock in this table. On the other hand Epsilon Energy Ltd. (NASDAQ:EPSN) is the least popular one with only 2 bullish hedge fund positions. Mammoth Energy Services, Inc. (NASDAQ:TUSK) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for TUSK is 41.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 31.6% in 2020 through December 2nd and still beat the market by 16 percentage points. Hedge funds were also right about betting on TUSK as the stock returned 40.6% since the end of Q3 (through 12/2) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Mammoth Energy Services Inc. (NASDAQ:TUSK)

Follow Mammoth Energy Services Inc. (NASDAQ:TUSK)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.