Before we spend countless hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Mammoth Energy Services, Inc. (NASDAQ:TUSK).

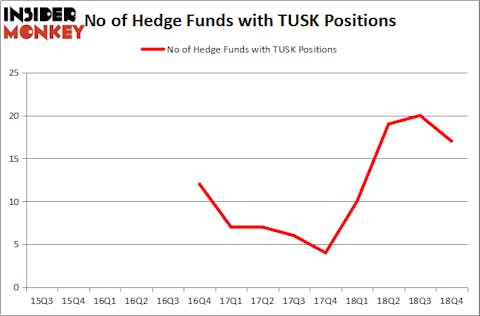

Is Mammoth Energy Services, Inc. (NASDAQ:TUSK) a safe investment today? Prominent investors are turning less bullish. The number of bullish hedge fund bets were trimmed by 3 in recent months. Our calculations also showed that TUSK isn’t among the 30 most popular stocks among hedge funds. TUSK was in 17 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 20 hedge funds in our database with TUSK positions at the end of the previous quarter.

In today’s marketplace there are several indicators stock traders can use to size up their holdings. A couple of the most useful indicators are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the elite investment managers can outpace the broader indices by a healthy margin (see the details here).

We’re going to view the key hedge fund action regarding Mammoth Energy Services, Inc. (NASDAQ:TUSK).

What does the smart money think about Mammoth Energy Services, Inc. (NASDAQ:TUSK)?

At Q4’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -15% from the previous quarter. By comparison, 10 hedge funds held shares or bullish call options in TUSK a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Wexford Capital held the most valuable stake in Mammoth Energy Services, Inc. (NASDAQ:TUSK), which was worth $395.4 million at the end of the fourth quarter. On the second spot was AQR Capital Management which amassed $6.7 million worth of shares. Moreover, Royce & Associates, Millennium Management, and GLG Partners were also bullish on Mammoth Energy Services, Inc. (NASDAQ:TUSK), allocating a large percentage of their portfolios to this stock.

Due to the fact that Mammoth Energy Services, Inc. (NASDAQ:TUSK) has witnessed bearish sentiment from the aggregate hedge fund industry, logic holds that there lies a certain “tier” of hedge funds that decided to sell off their positions entirely by the end of the third quarter. Interestingly, Murray Stahl’s Horizon Asset Management said goodbye to the biggest investment of the 700 funds followed by Insider Monkey, valued at about $2.8 million in stock. Jim Simons’s fund, Renaissance Technologies, also dropped its stock, about $1.2 million worth. These moves are interesting, as total hedge fund interest dropped by 3 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Mammoth Energy Services, Inc. (NASDAQ:TUSK). These stocks are Origin Bancorp, Inc. (NASDAQ:OBNK), Mesa Laboratories, Inc. (NASDAQ:MLAB), Seabridge Gold, Inc. (NYSE:SA), and Helix Energy Solutions Group Inc. (NYSE:HLX). This group of stocks’ market caps resemble TUSK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OBNK | 5 | 14016 | -1 |

| MLAB | 9 | 47877 | -1 |

| SA | 8 | 43195 | 1 |

| HLX | 18 | 34360 | 2 |

| Average | 10 | 34862 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $35 million. That figure was $421 million in TUSK’s case. Helix Energy Solutions Group Inc. (NYSE:HLX) is the most popular stock in this table. On the other hand Origin Bancorp, Inc. (NASDAQ:OBNK) is the least popular one with only 5 bullish hedge fund positions. Mammoth Energy Services, Inc. (NASDAQ:TUSK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately TUSK wasn’t nearly as popular as these 15 stock and hedge funds that were betting on TUSK were disappointed as the stock returned 1.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.