Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about TTEC Holdings, Inc. (NASDAQ:TTEC) in this article.

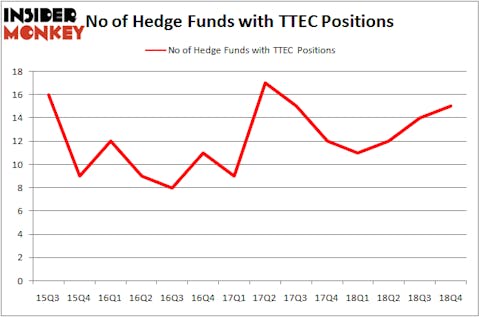

TTEC Holdings, Inc. (NASDAQ:TTEC) was in 15 hedge funds’ portfolios at the end of the fourth quarter of 2018. TTEC investors should be aware of an increase in hedge fund interest recently. There were 14 hedge funds in our database with TTEC positions at the end of the previous quarter. Our calculations also showed that TTEC isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a glance at the key hedge fund action surrounding TTEC Holdings, Inc. (NASDAQ:TTEC).

What does the smart money think about TTEC Holdings, Inc. (NASDAQ:TTEC)?

At the end of the fourth quarter, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in TTEC over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in TTEC Holdings, Inc. (NASDAQ:TTEC) was held by Renaissance Technologies, which reported holding $10.4 million worth of stock at the end of September. It was followed by Millennium Management with a $3.1 million position. Other investors bullish on the company included Citadel Investment Group, Leucadia National, and D E Shaw.

Now, specific money managers have been driving this bullishness. Element Capital Management, managed by Jeffrey Talpins, assembled the largest position in TTEC Holdings, Inc. (NASDAQ:TTEC). Element Capital Management had $0.3 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also made a $0.2 million investment in the stock during the quarter. The only other fund with a brand new TTEC position is Joel Greenblatt’s Gotham Asset Management.

Let’s now take a look at hedge fund activity in other stocks similar to TTEC Holdings, Inc. (NASDAQ:TTEC). We will take a look at GreenTree Hospitality Group Ltd. (NYSE:GHG), Plantronics, Inc. (NYSE:PLT), Autolus Therapeutics plc (NASDAQ:AUTL), and Mallinckrodt plc (NYSE:MNK). This group of stocks’ market valuations are similar to TTEC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GHG | 7 | 17999 | -4 |

| PLT | 16 | 72043 | -9 |

| AUTL | 6 | 408867 | -5 |

| MNK | 22 | 223543 | 2 |

| Average | 12.75 | 180613 | -4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $181 million. That figure was $20 million in TTEC’s case. Mallinckrodt plc (NYSE:MNK) is the most popular stock in this table. On the other hand Autolus Therapeutics plc (NASDAQ:AUTL) is the least popular one with only 6 bullish hedge fund positions. TTEC Holdings, Inc. (NASDAQ:TTEC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on TTEC as the stock returned 24.7% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.