“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. This article will lay out and discuss the hedge fund and institutional investor sentiment towards TTEC Holdings, Inc. (NASDAQ:TTEC).

Hedge fund interest in TTEC Holdings, Inc. (NASDAQ:TTEC) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Dril-Quip, Inc. (NYSE:DRQ), Brinker International, Inc. (NYSE:EAT), and WestAmerica Bancorp. (NASDAQ:WABC) to gather more data points.

According to most traders, hedge funds are seen as slow, old investment vehicles of the past. While there are more than 8000 funds trading today, Our experts hone in on the elite of this group, around 750 funds. Most estimates calculate that this group of people orchestrate bulk of the hedge fund industry’s total asset base, and by paying attention to their best stock picks, Insider Monkey has deciphered numerous investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s check out the fresh hedge fund action surrounding TTEC Holdings, Inc. (NASDAQ:TTEC).

What have hedge funds been doing with TTEC Holdings, Inc. (NASDAQ:TTEC)?

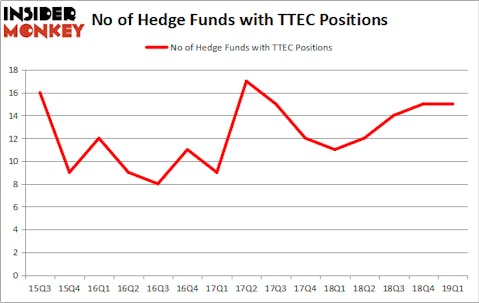

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2018. On the other hand, there were a total of 11 hedge funds with a bullish position in TTEC a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in TTEC Holdings, Inc. (NASDAQ:TTEC), which was worth $13.9 million at the end of the first quarter. On the second spot was Citadel Investment Group which amassed $3.9 million worth of shares. Moreover, Millennium Management, Arrowstreet Capital, and D E Shaw were also bullish on TTEC Holdings, Inc. (NASDAQ:TTEC), allocating a large percentage of their portfolios to this stock.

Seeing as TTEC Holdings, Inc. (NASDAQ:TTEC) has faced a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there exists a select few fund managers who sold off their full holdings heading into Q3. It’s worth mentioning that Jeffrey Talpins’s Element Capital Management dropped the largest stake of the 700 funds monitored by Insider Monkey, valued at about $0.3 million in stock. Michael Platt and William Reeves’s fund, BlueCrest Capital Mgmt., also cut its stock, about $0.3 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as TTEC Holdings, Inc. (NASDAQ:TTEC) but similarly valued. These stocks are Dril-Quip, Inc. (NYSE:DRQ), Brinker International, Inc. (NYSE:EAT), WestAmerica Bancorp. (NASDAQ:WABC), and Pacific Premier Bancorp, Inc. (NASDAQ:PPBI). This group of stocks’ market caps resemble TTEC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DRQ | 17 | 142274 | -2 |

| EAT | 29 | 252843 | 3 |

| WABC | 6 | 10495 | 1 |

| PPBI | 11 | 87156 | 2 |

| Average | 15.75 | 123192 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $123 million. That figure was $27 million in TTEC’s case. Brinker International, Inc. (NYSE:EAT) is the most popular stock in this table. On the other hand WestAmerica Bancorp. (NASDAQ:WABC) is the least popular one with only 6 bullish hedge fund positions. TTEC Holdings, Inc. (NASDAQ:TTEC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on TTEC as the stock returned 25.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.