The Insider Monkey team has completed processing the quarterly 13F filings for the March quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Travelport Worldwide Ltd (NYSE:TVPT).

Travelport Worldwide Ltd (NYSE:TVPT) investors should be aware of a decrease in support from the world’s most elite money managers recently. TVPT was in 19 hedge funds’ portfolios at the end of March. There were 24 hedge funds in our database with TVPT positions at the end of the previous quarter. Our calculations also showed that tvpt isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s go over the latest hedge fund action surrounding Travelport Worldwide Ltd (NYSE:TVPT).

Hedge fund activity in Travelport Worldwide Ltd (NYSE:TVPT)

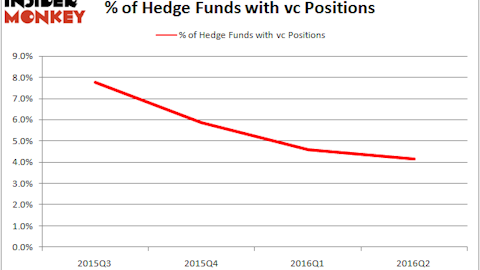

Heading into the second quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -21% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in TVPT over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Travelport Worldwide Ltd (NYSE:TVPT) was held by Elliott Management, which reported holding $106.2 million worth of stock at the end of March. It was followed by Alpine Associates with a $94.3 million position. Other investors bullish on the company included Water Island Capital, Paulson & Co, and Springbok Capital.

Judging by the fact that Travelport Worldwide Ltd (NYSE:TVPT) has witnessed falling interest from the aggregate hedge fund industry, logic holds that there is a sect of money managers that elected to cut their positions entirely last quarter. At the top of the heap, Ken Griffin’s Citadel Investment Group cut the biggest stake of the 700 funds tracked by Insider Monkey, worth an estimated $37.7 million in stock. Michael Doheny’s fund, Freshford Capital Management, also sold off its stock, about $24.9 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 5 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Travelport Worldwide Ltd (NYSE:TVPT) but similarly valued. These stocks are Cott Corporation (NYSE:COT), Renasant Corporation (NASDAQ:RNST), The Bank of N.T. Butterfield & Son Limited (NYSE:NTB), and Retail Opportunity Investments Corp (NASDAQ:ROIC). This group of stocks’ market values are closest to TVPT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COT | 28 | 500500 | 0 |

| RNST | 16 | 35925 | 3 |

| NTB | 15 | 128157 | -1 |

| ROIC | 8 | 57661 | -2 |

| Average | 16.75 | 180561 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $181 million. That figure was $409 million in TVPT’s case. Cott Corporation (NYSE:COT) is the most popular stock in this table. On the other hand Retail Opportunity Investments Corp (NASDAQ:ROIC) is the least popular one with only 8 bullish hedge fund positions. Travelport Worldwide Ltd (NYSE:TVPT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on TVPT, though not to the same extent, as the stock returned 0.1% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.