The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Tractor Supply Company (NASDAQ:TSCO) from the perspective of those elite funds.

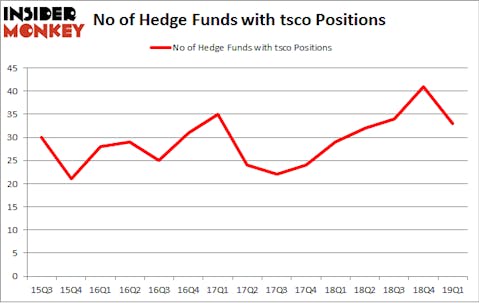

Tractor Supply Company (NASDAQ:TSCO) shareholders have witnessed a decrease in enthusiasm from smart money in recent months. TSCO was in 33 hedge funds’ portfolios at the end of March. There were 41 hedge funds in our database with TSCO holdings at the end of the previous quarter. Our calculations also showed that tsco isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

Let’s analyze the new hedge fund action encompassing Tractor Supply Company (NASDAQ:TSCO).

How have hedgies been trading Tractor Supply Company (NASDAQ:TSCO)?

At Q1’s end, a total of 33 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -20% from one quarter earlier. On the other hand, there were a total of 29 hedge funds with a bullish position in TSCO a year ago. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

The largest stake in Tractor Supply Company (NASDAQ:TSCO) was held by AQR Capital Management, which reported holding $118.8 million worth of stock at the end of March. It was followed by Samlyn Capital with a $93.3 million position. Other investors bullish on the company included Arrowstreet Capital, Citadel Investment Group, and Park Presidio Capital.

Since Tractor Supply Company (NASDAQ:TSCO) has faced falling interest from the smart money, it’s safe to say that there was a specific group of fund managers that decided to sell off their full holdings in the third quarter. At the top of the heap, Gregg Moskowitz’s Interval Partners dumped the biggest position of the 700 funds followed by Insider Monkey, worth close to $20.4 million in stock. Jim Simons’s fund, Renaissance Technologies, also said goodbye to its stock, about $10.4 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 8 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to Tractor Supply Company (NASDAQ:TSCO). These stocks are Cna Financial Corporation (NYSE:CNA), Seattle Genetics, Inc. (NASDAQ:SGEN), Elanco Animal Health Incorporated (NYSE:ELAN), and Old Dominion Freight Line, Inc. (NASDAQ:ODFL). This group of stocks’ market valuations match TSCO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNA | 14 | 76729 | 1 |

| SGEN | 19 | 4016031 | 3 |

| ELAN | 33 | 1055959 | 15 |

| ODFL | 26 | 220250 | 6 |

| Average | 23 | 1342242 | 6.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $1342 million. That figure was $580 million in TSCO’s case. Elanco Animal Health Incorporated (NYSE:ELAN) is the most popular stock in this table. On the other hand Cna Financial Corporation (NYSE:CNA) is the least popular one with only 14 bullish hedge fund positions. Tractor Supply Company (NASDAQ:TSCO) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on TSCO as the stock returned 3.4% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.