“The end to the U.S. Government shutdown, reports of progress on China-U.S. trade talks, and the Federal Reserve’s confirmation that it did not plan further interest rate hikes in 2019 allayed investor fears and drove U.S. markets substantially higher in the first quarter of the year. Global markets followed suit pretty much across the board delivering what some market participants described as a “V-shaped” recovery,” This is how Evermore Global Value summarized the first quarter in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

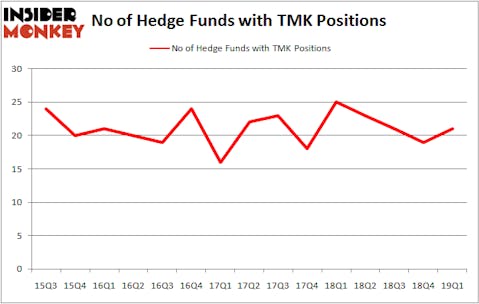

Torchmark Corporation (NYSE:TMK) has seen an increase in hedge fund sentiment of late. Our calculations also showed that TMK isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Paul Marshall of Marshall Wace

Let’s take a peek at the latest hedge fund action regarding Torchmark Corporation (NYSE:TMK).

How are hedge funds trading Torchmark Corporation (NYSE:TMK)?

At Q1’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from the fourth quarter of 2018. On the other hand, there were a total of 25 hedge funds with a bullish position in TMK a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

The largest stake in Torchmark Corporation (NYSE:TMK) was held by Berkshire Hathaway, which reported holding $520.7 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $79.4 million position. Other investors bullish on the company included AQR Capital Management, Pzena Investment Management, and Prospector Partners.

As industrywide interest jumped, specific money managers have jumped into Torchmark Corporation (NYSE:TMK) headfirst. Element Capital Management, managed by Jeffrey Talpins, created the most valuable position in Torchmark Corporation (NYSE:TMK). Element Capital Management had $1.6 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $1.4 million investment in the stock during the quarter. The other funds with brand new TMK positions are Roy Vermus and Shlomi Bracha’s Noked Capital, Alec Litowitz and Ross Laser’s Magnetar Capital, and Bruce Kovner’s Caxton Associates LP.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Torchmark Corporation (NYSE:TMK) but similarly valued. These stocks are DaVita Inc (NYSE:DVA), ASE Technology Holding Co., Ltd. (NYSE:ASX), United Rentals, Inc. (NYSE:URI), and Dropbox, Inc. (NASDAQ:DBX). This group of stocks’ market valuations match TMK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DVA | 36 | 3100211 | -3 |

| ASX | 9 | 182312 | 2 |

| URI | 45 | 819606 | -3 |

| DBX | 33 | 427201 | -2 |

| Average | 30.75 | 1132333 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.75 hedge funds with bullish positions and the average amount invested in these stocks was $1132 million. That figure was $724 million in TMK’s case. United Rentals, Inc. (NYSE:URI) is the most popular stock in this table. On the other hand ASE Technology Holding Co., Ltd. (NYSE:ASX) is the least popular one with only 9 bullish hedge fund positions. Torchmark Corporation (NYSE:TMK) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on TMK as the stock returned 5.8% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.