Is The TJX Companies, Inc. (NYSE:TJX) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They fail miserably sometimes but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

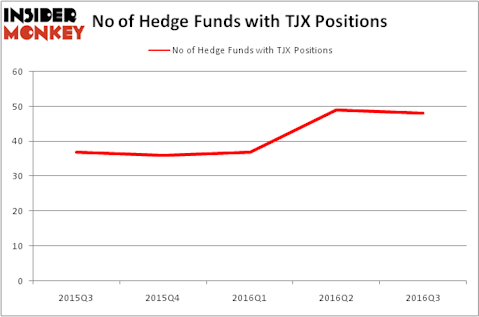

The TJX Companies, Inc. (NYSE:TJX) has seen a slight decrease in hedge fund interest during the third quarter. There were 48 funds from our database long the stock at the end of September, down from 49 funds a quarter earlier. However, to get a better sense of its popularity, we will also compare TJX to other stocks, including Morgan Stanley (NYSE:MS), Ford Motor Company (NYSE:F), and Kimberly Clark Corp (NYSE:KMB), at the end of this article.

Follow Tjx Companies Inc (NYSE:TJX)

Follow Tjx Companies Inc (NYSE:TJX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

View Apart /shutterstock.com

Keeping this in mind, we’re going to take a peek at the fresh action encompassing The TJX Companies, Inc. (NYSE:TJX).

How have hedgies been trading The TJX Companies, Inc. (NYSE:TJX)?

At the end of the third quarter, a total of 48 of the hedge funds tracked by Insider Monkey held long positions in this stock, down by 2% from the previous quarter. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Ric Dillon’s Diamond Hill Capital has the largest position in The TJX Companies, Inc. (NYSE:TJX), worth close to $277.6 million, corresponding to 1.7% of its total 13F portfolio. Sitting at the No. 2 spot is Two Sigma Advisors, managed by John Overdeck and David Siegel, which holds a $202.5 million position; the fund has 0.9% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions include Israel Englander’s Millennium Management, Principal Global Investors’ Columbus Circle Investors, and Cliff Asness’s AQR Capital Management.