We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards The Geo Group, Inc. (NYSE:GEO).

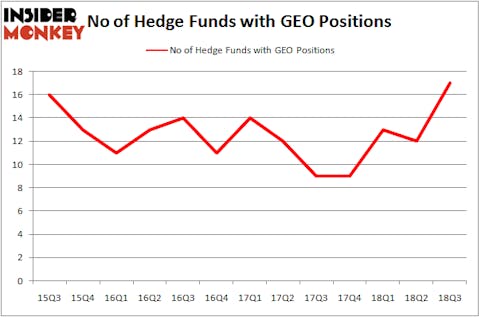

The Geo Group, Inc. (NYSE:GEO) was in 17 hedge funds’ portfolios at the end of the third quarter of 2018. GEO has experienced an increase in activity from the world’s largest hedge funds in recent months. There were 12 hedge funds in our database with GEO holdings at the end of the previous quarter. Our calculations also showed that GEO isn’t among the 30 most popular stocks among hedge funds.

At the moment there are tons of formulas market participants have at their disposal to size up stocks. Some of the less known formulas are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the best hedge fund managers can outclass their index-focused peers by a very impressive margin (see the details here).

We’re going to take a peek at the recent hedge fund action surrounding The Geo Group, Inc. (NYSE:GEO).

How have hedgies been trading The Geo Group, Inc. (NYSE:GEO)?

Heading into the fourth quarter of 2018, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 42% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards GEO over the last 13 quarters. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, Capital Growth Management was the largest shareholder of The Geo Group, Inc. (NYSE:GEO), with a stake worth $39 million reported as of the end of September. Trailing Capital Growth Management was Millennium Management, which amassed a stake valued at $18.8 million. D E Shaw, Two Sigma Advisors, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. Capital Growth Management, managed by Ken Heebner, assembled the biggest position in The Geo Group, Inc. (NYSE:GEO). Capital Growth Management had $39 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $4.6 million position during the quarter. The other funds with brand new GEO positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, David Costen Haley’s HBK Investments, and Mike Vranos’s Ellington.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as The Geo Group, Inc. (NYSE:GEO) but similarly valued. We will take a look at AVX Corporation (NYSE:AVX), BlackLine, Inc. (NASDAQ:BL), CNX Resources Corporation (NYSE:CNX), and SiteOne Landscape Supply, Inc. (NYSE:SITE). This group of stocks’ market caps match GEO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVX | 16 | 151569 | 3 |

| BL | 13 | 274605 | -2 |

| CNX | 23 | 950530 | 0 |

| SITE | 15 | 108915 | 4 |

| Average | 16.75 | 371405 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $371 million. That figure was $107 million in GEO’s case. CNX Resources Corporation (NYSE:CNX) is the most popular stock in this table. On the other hand BlackLine, Inc. (NASDAQ:BL) is the least popular one with only 13 bullish hedge fund positions. The Geo Group, Inc. (NYSE:GEO) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CNX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.