We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Teva Pharmaceutical Industries Limited (NYSE:TEVA).

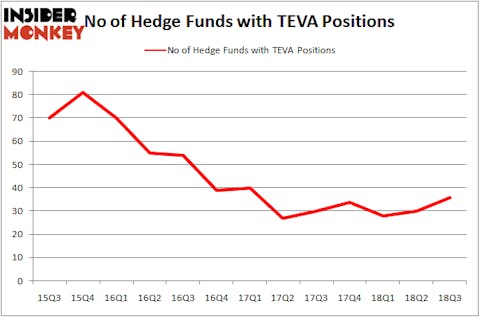

Is Teva Pharmaceutical Industries Limited (NYSE:TEVA) a buy, sell, or hold? The best stock pickers are in an optimistic mood. The number of bullish hedge fund positions went up by 6 recently. Our calculations also showed that TEVA isn’t among the 30 most popular stocks among hedge funds. TEVA was in 36 hedge funds’ portfolios at the end of September. There were 30 hedge funds in our database with TEVA positions at the end of the previous quarter.

To most market participants, hedge funds are viewed as worthless, old financial tools of the past. While there are greater than 8,000 funds trading today, Our researchers choose to focus on the crème de la crème of this group, around 700 funds. These money managers oversee bulk of the hedge fund industry’s total asset base, and by shadowing their inimitable investments, Insider Monkey has come up with various investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Warren Buffett of Berkshire Hathaway

We’re going to take a look at the latest hedge fund action regarding Teva Pharmaceutical Industries Limited (NYSE:TEVA).

How are hedge funds trading Teva Pharmaceutical Industries Limited (NYSE:TEVA)?

At Q3’s end, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 20% from the second quarter of 2018. On the other hand, there were a total of 34 hedge funds with a bullish position in TEVA at the beginning of this year. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

More specifically, Berkshire Hathaway was the largest shareholder of Teva Pharmaceutical Industries Limited (NYSE:TEVA), with a stake worth $931.6 million reported as of the end of September. Trailing Berkshire Hathaway was Abrams Capital Management, which amassed a stake valued at $420.5 million. Highfields Capital Management, Polaris Capital Management, and Brahman Capital were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Orbis Investment Management, managed by William B. Gray, assembled the most valuable position in Teva Pharmaceutical Industries Limited (NYSE:TEVA). Orbis Investment Management had $45.1 million invested in the company at the end of the quarter. Robert B. Gillam’s McKinley Capital Management also initiated a $33.3 million position during the quarter. The following funds were also among the new TEVA investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Thomas Bailard’s Bailard Inc, and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s go over hedge fund activity in other stocks similar to Teva Pharmaceutical Industries Limited (NYSE:TEVA). We will take a look at Ryanair Holdings plc (NASDAQ:RYAAY), Best Buy Co., Inc. (NYSE:BBY), Tyson Foods, Inc. (NYSE:TSN), and Liberty Global Plc (NASDAQ:LBTYK). All of these stocks’ market caps are closest to TEVA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RYAAY | 13 | 318987 | 4 |

| BBY | 27 | 1563258 | -3 |

| TSN | 39 | 1590018 | 8 |

| LBTYK | 41 | 3979823 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $1.86 billion. That figure was $2.51 billion in TEVA’s case. Liberty Global Plc (NASDAQ:LBTYK) is the most popular stock in this table. On the other hand Ryanair Holdings plc (NASDAQ:RYAAY) is the least popular one with only 13 bullish hedge fund positions. Teva Pharmaceutical Industries Limited (NYSE:TEVA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LBTYK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.