World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

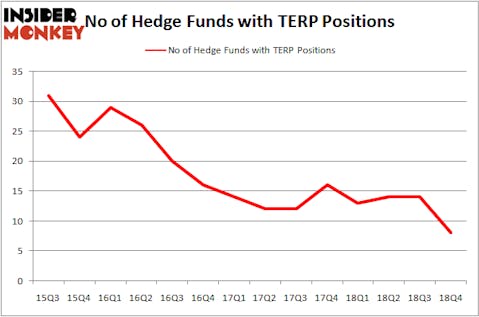

Is TerraForm Power Inc (NASDAQ:TERP) a safe investment now? Investors who are in the know are becoming less confident. The number of long hedge fund positions fell by 6 recently. Our calculations also showed that TERP isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are dozens of formulas stock traders put to use to assess their holdings. A couple of the most underrated formulas are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the best fund managers can trounce the S&P 500 by a significant margin (see the details here).

Let’s take a peek at the key hedge fund action regarding TerraForm Power Inc (NASDAQ:TERP).

What does the smart money think about TerraForm Power Inc (NASDAQ:TERP)?

At the end of the fourth quarter, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of -43% from one quarter earlier. By comparison, 13 hedge funds held shares or bullish call options in TERP a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Among these funds, Strategic Value Partners held the most valuable stake in TerraForm Power Inc (NASDAQ:TERP), which was worth $112.6 million at the end of the third quarter. On the second spot was Appaloosa Management LP which amassed $30.1 million worth of shares. Moreover, Renaissance Technologies, D E Shaw, and Highbridge Capital Management were also bullish on TerraForm Power Inc (NASDAQ:TERP), allocating a large percentage of their portfolios to this stock.

Because TerraForm Power Inc (NASDAQ:TERP) has witnessed bearish sentiment from hedge fund managers, it’s easy to see that there was a specific group of money managers that slashed their positions entirely heading into Q3. It’s worth mentioning that Bernard Lambilliotte’s Ecofin Ltd dumped the largest position of the 700 funds watched by Insider Monkey, comprising an estimated $8.8 million in stock, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt. was right behind this move, as the fund said goodbye to about $0.9 million worth. These transactions are interesting, as total hedge fund interest was cut by 6 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to TerraForm Power Inc (NASDAQ:TERP). We will take a look at Tegna Inc (NYSE:TGNA), Retail Properties of America Inc (NYSE:RPAI), Meredith Corporation (NYSE:MDP), and Genworth Financial Inc (NYSE:GNW). All of these stocks’ market caps match TERP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TGNA | 22 | 309181 | -1 |

| RPAI | 15 | 175160 | 1 |

| MDP | 12 | 312287 | -5 |

| GNW | 22 | 70350 | 0 |

| Average | 17.75 | 216745 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $217 million. That figure was $192 million in TERP’s case. Tegna Inc (NYSE:TGNA) is the most popular stock in this table. On the other hand Meredith Corporation (NYSE:MDP) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks TerraForm Power Inc (NASDAQ:TERP) is even less popular than MDP. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on TERP, though not to the same extent, as the stock returned 21.9% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.