Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 20% in 2019 (through September 30th). Conversely, hedge funds’ 20 preferred S&P 500 stocks generated a return of 24% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ consensus stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Tenet Healthcare Corporation (NYSE:THC).

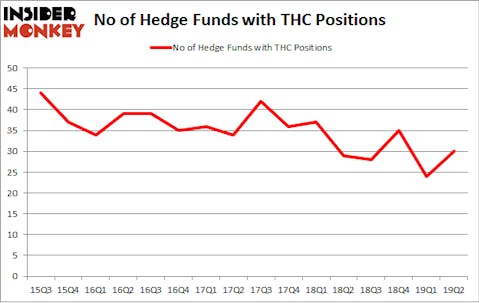

Tenet Healthcare Corporation (NYSE:THC) was in 30 hedge funds’ portfolios at the end of the second quarter of 2019. THC investors should be aware of an increase in enthusiasm from smart money in recent months. There were 24 hedge funds in our database with THC positions at the end of the previous quarter. Our calculations also showed that THC isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most investors, hedge funds are seen as underperforming, outdated investment tools of years past. While there are more than 8000 funds with their doors open today, Our researchers choose to focus on the top tier of this group, around 750 funds. These hedge fund managers shepherd most of all hedge funds’ total capital, and by paying attention to their finest investments, Insider Monkey has brought to light many investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points a year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the latest hedge fund action encompassing Tenet Healthcare Corporation (NYSE:THC).

What does smart money think about Tenet Healthcare Corporation (NYSE:THC)?

At the end of the second quarter, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 25% from the first quarter of 2019. By comparison, 29 hedge funds held shares or bullish call options in THC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Glenview Capital, managed by Larry Robbins, holds the most valuable position in Tenet Healthcare Corporation (NYSE:THC). Glenview Capital has a $370.2 million position in the stock, comprising 3.4% of its 13F portfolio. Sitting at the No. 2 spot is Nantahala Capital Management, led by Wilmot B. Harkey and Daniel Mack, holding a $52.3 million call position; 1.6% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that are bullish consist of Stephen DuBois’s Camber Capital Management, Wilmot B. Harkey and Daniel Mack’s Nantahala Capital Management and Stephen C. Freidheim’s Cyrus Capital Partners.

As aggregate interest increased, key money managers were breaking ground themselves. Partner Fund Management, managed by Christopher James, created the most outsized position in Tenet Healthcare Corporation (NYSE:THC). Partner Fund Management had $30.7 million invested in the company at the end of the quarter. Jared Nussbaum’s Nut Tree Capital also initiated a $12 million position during the quarter. The other funds with brand new THC positions are Arthur B Cohen and Joseph Healey’s Healthcor Management LP, Joseph Edelman’s Perceptive Advisors, and Krishen Sud’s Sivik Global Healthcare.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Tenet Healthcare Corporation (NYSE:THC) but similarly valued. These stocks are Retail Opportunity Investments Corp (NASDAQ:ROIC), Anixter International Inc. (NYSE:AXE), TowneBank (NASDAQ:TOWN), and Greif, Inc. (NYSE:GEF). This group of stocks’ market caps are closest to THC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ROIC | 13 | 109601 | 5 |

| AXE | 20 | 258192 | -3 |

| TOWN | 7 | 36621 | 0 |

| GEF | 21 | 90122 | 0 |

| Average | 15.25 | 123634 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $124 million. That figure was $669 million in THC’s case. Greif, Inc. (NYSE:GEF) is the most popular stock in this table. On the other hand TowneBank (NASDAQ:TOWN) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Tenet Healthcare Corporation (NYSE:THC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on THC as the stock returned 7.1% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.