“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards Teck Resources Ltd (NYSE:TECK) and see how it was affected.

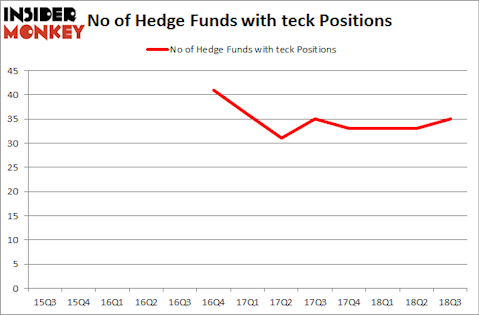

Teck Resources Ltd (NYSE:TECK) was in 35 hedge funds’ portfolios at the end of the third quarter of 2018. TECK has seen an increase in enthusiasm from smart money in recent months. There were 33 hedge funds in our database with TECK positions at the end of the previous quarter. Our calculations also showed that teck isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are assumed to be underperforming, outdated financial tools of yesteryear. While there are greater than 8,000 funds with their doors open at present, Our experts choose to focus on the aristocrats of this club, approximately 700 funds. These money managers direct the majority of all hedge funds’ total asset base, and by shadowing their matchless equity investments, Insider Monkey has formulated numerous investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a peek at the recent hedge fund action surrounding Teck Resources Ltd (NYSE:TECK).

What have hedge funds been doing with Teck Resources Ltd (NYSE:TECK)?

At Q3’s end, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from one quarter earlier. By comparison, 33 hedge funds held shares or bullish call options in TECK heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Teck Resources Ltd (NYSE:TECK) was held by Impala Asset Management, which reported holding $364.1 million worth of stock at the end of September. It was followed by GMT Capital with a $162.7 million position. Other investors bullish on the company included Citadel Investment Group, AQR Capital Management, and D E Shaw.

As aggregate interest increased, some big names have jumped into Teck Resources Ltd (NYSE:TECK) headfirst. Point72 Asset Management, managed by Steve Cohen, established the most valuable position in Teck Resources Ltd (NYSE:TECK). Point72 Asset Management had $23.8 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $9.9 million investment in the stock during the quarter. The other funds with brand new TECK positions are Philippe Jabre’s Jabre Capital Partners, Bruce Kovner’s Caxton Associates LP, and Todd J. Kantor’s Encompass Capital Advisors.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Teck Resources Ltd (NYSE:TECK) but similarly valued. We will take a look at Seagate Technology plc (NASDAQ:STX), WestRock Company (NYSE:WRK), SS&C Technologies Holdings, Inc. (NASDAQ:SSNC), and The Cooper Companies, Inc. (NYSE:COO). All of these stocks’ market caps are similar to TECK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STX | 27 | 1761695 | -2 |

| WRK | 33 | 618833 | 10 |

| SSNC | 41 | 1698395 | 6 |

| COO | 18 | 1125764 | 0 |

| Average | 29.75 | 1301172 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $1.30 billion. That figure was $1.10 billion in TECK’s case. SS&C Technologies Holdings, Inc. (NASDAQ:SSNC) is the most popular stock in this table. On the other hand The Cooper Companies, Inc. (NYSE:COO) is the least popular one with only 18 bullish hedge fund positions. Teck Resources Ltd (NYSE:TECK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SSNC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.