With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the second quarter. One of these stocks was T-Mobile US, Inc. (NASDAQ:TMUS).

Is T-Mobile US, Inc. (NASDAQ:TMUS) a healthy stock for your portfolio? The best stock pickers are turning less bullish. The number of long hedge fund positions went down by 18 recently. Our calculations also showed that TMUS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are a multitude of indicators stock market investors have at their disposal to evaluate publicly traded companies. A duo of the most innovative indicators are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the top investment managers can trounce the S&P 500 by a superb amount (see the details here).

Larry Robbins of Glenview Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to go over the recent hedge fund action surrounding T-Mobile US, Inc. (NASDAQ:TMUS).

What have hedge funds been doing with T-Mobile US, Inc. (NASDAQ:TMUS)?

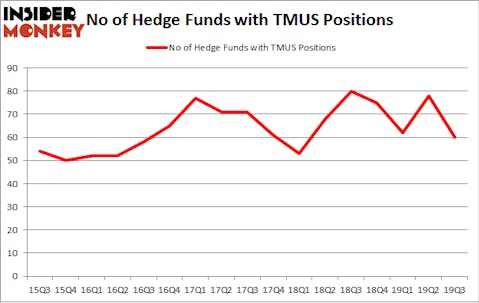

Heading into the fourth quarter of 2019, a total of 60 of the hedge funds tracked by Insider Monkey were long this stock, a change of -23% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TMUS over the last 17 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Lee Ainslie’s Maverick Capital has the number one position in T-Mobile US, Inc. (NASDAQ:TMUS), worth close to $292.8 million, accounting for 4.3% of its total 13F portfolio. On Maverick Capital’s heels is Glenview Capital, managed by Larry Robbins, which holds a $112 million position; 1.2% of its 13F portfolio is allocated to the company. Remaining members of the smart money that are bullish include Ken Griffin’s Citadel Investment Group, Cliff Asness’s AQR Capital Management and Keith Meister’s Corvex Capital. In terms of the portfolio weights assigned to each position Tekne Capital Management allocated the biggest weight to T-Mobile US, Inc. (NASDAQ:TMUS), around 12.54% of its portfolio. Asturias Capital is also relatively very bullish on the stock, earmarking 11.6 percent of its 13F equity portfolio to TMUS.

Due to the fact that T-Mobile US, Inc. (NASDAQ:TMUS) has faced bearish sentiment from the aggregate hedge fund industry, logic holds that there lies a certain “tier” of fund managers who were dropping their positions entirely heading into Q4. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital said goodbye to the biggest investment of all the hedgies tracked by Insider Monkey, worth about $136.9 million in stock. Andrew Immerman and Jeremy Schiffman’s fund, Palestra Capital Management, also cut its stock, about $105.5 million worth. These moves are interesting, as aggregate hedge fund interest fell by 18 funds heading into Q4.

Let’s go over hedge fund activity in other stocks similar to T-Mobile US, Inc. (NASDAQ:TMUS). These stocks are Banco Santander, S.A. (NYSE:SAN), Mitsubishi UFJ Financial Group Inc (NYSE:MUFG), Banco Bradesco SA (NYSE:BBD), and China Life Insurance Company Limited (NYSE:LFC). This group of stocks’ market valuations match TMUS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SAN | 20 | 645984 | -2 |

| MUFG | 10 | 60064 | -2 |

| BBD | 16 | 595049 | 2 |

| LFC | 8 | 34563 | 0 |

| Average | 13.5 | 333915 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $334 million. That figure was $1457 million in TMUS’s case. Banco Santander, S.A. (NYSE:SAN) is the most popular stock in this table. On the other hand China Life Insurance Company Limited (NYSE:LFC) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks T-Mobile US, Inc. (NASDAQ:TMUS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately TMUS wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TMUS were disappointed as the stock returned -0.3% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.