During the first half of the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by about 4 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of SunCoke Energy Partners LP (NYSE:SXCP) and see how the stock is affected by the recent hedge fund activity.

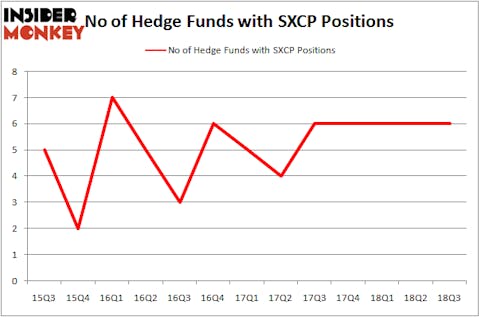

SunCoke Energy Partners LP (NYSE:SXCP) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 6 hedge funds’ portfolios at the end of the third quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Preferred Apartment Communities Inc. (NYSEAMEX:APTS), American Renal Associates Holdings, Inc (NYSE:ARA), and Eldorado Gold Corp (NYSE:EGO) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to review the recent hedge fund action surrounding SunCoke Energy Partners LP (NYSE:SXCP).

What have hedge funds been doing with SunCoke Energy Partners LP (NYSE:SXCP)?

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, representing no change from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SXCP over the last 13 quarters. With the smart money’s capital changing hands, there exists a few key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Jim Simons’s Renaissance Technologies has the biggest position in SunCoke Energy Partners LP (NYSE:SXCP), worth close to $1.3 million, corresponding to less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is GLG Partners, managed by Noam Gottesman, which holds a $1.2 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining peers with similar optimism comprise John Thiessen’s Vertex One Asset Management, Matthew Hulsizer’s PEAK6 Capital Management and Matthew Hulsizer’s PEAK6 Capital Management.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s also examine hedge fund activity in other stocks similar to SunCoke Energy Partners LP (NYSE:SXCP). These stocks are Preferred Apartment Communities Inc. (NYSE:APTS), American Renal Associates Holdings, Inc (NYSE:ARA), Eldorado Gold Corp (NYSE:EGO), and Grupo Supervielle S.A. (NYSE:SUPV). This group of stocks’ market valuations match SXCP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| APTS | 3 | 3119 | -1 |

| ARA | 9 | 397077 | 0 |

| EGO | 9 | 4868 | 0 |

| SUPV | 10 | 34395 | -6 |

| Average | 7.75 | 109865 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.75 hedge funds with bullish positions and the average amount invested in these stocks was $110 million. That figure was $3 million in SXCP’s case. Grupo Supervielle S.A. (NYSE:SUPV) is the most popular stock in this table. On the other hand Preferred Apartment Communities Inc. (NYSEAMEX:APTS) is the least popular one with only 3 bullish hedge fund positions. SunCoke Energy Partners LP (NYSE:SXCP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SUPV might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.