We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of Summit Hotel Properties Inc (NYSE:INN) based on that data.

Is Summit Hotel Properties Inc (NYSE:INN) a first-rate investment today? The best stock pickers are taking a bearish view. The number of bullish hedge fund positions fell by 1 in recent months. Our calculations also showed that INN isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are plenty of indicators investors can use to evaluate their holdings. A couple of the best indicators are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the top money managers can outperform the broader indices by a solid margin (see the details here).

We’re going to take a look at the new hedge fund action regarding Summit Hotel Properties Inc (NYSE:INN).

What have hedge funds been doing with Summit Hotel Properties Inc (NYSE:INN)?

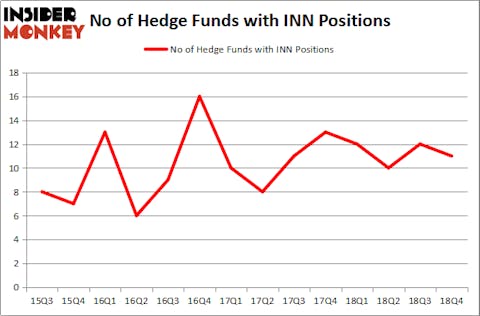

At the end of the fourth quarter, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from the previous quarter. By comparison, 12 hedge funds held shares or bullish call options in INN a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Millennium Management, managed by Israel Englander, holds the number one position in Summit Hotel Properties Inc (NYSE:INN). Millennium Management has a $7.1 million position in the stock, comprising less than 0.1%% of its 13F portfolio. On Millennium Management’s heels is Ken Griffin of Citadel Investment Group, with a $0.9 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining members of the smart money that are bullish comprise John Overdeck and David Siegel’s Two Sigma Advisors, D. E. Shaw’s D E Shaw and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Judging by the fact that Summit Hotel Properties Inc (NYSE:INN) has witnessed declining sentiment from the aggregate hedge fund industry, it’s safe to say that there were a few funds that decided to sell off their positions entirely in the third quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management cut the biggest position of all the hedgies followed by Insider Monkey, totaling about $3.7 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also said goodbye to its stock, about $0.4 million worth. These transactions are important to note, as aggregate hedge fund interest was cut by 1 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Summit Hotel Properties Inc (NYSE:INN) but similarly valued. We will take a look at Quotient Technology Inc. (NYSE:QUOT), Tivity Health, Inc. (NASDAQ:TVTY), Lakeland Financial Corporation (NASDAQ:LKFN), and Denny’s Corporation (NASDAQ:DENN). This group of stocks’ market caps are similar to INN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QUOT | 12 | 141411 | -1 |

| TVTY | 21 | 130125 | 2 |

| LKFN | 11 | 19872 | -1 |

| DENN | 19 | 163526 | -3 |

| Average | 15.75 | 113734 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $114 million. That figure was $12 million in INN’s case. Tivity Health, Inc. (NASDAQ:TVTY) is the most popular stock in this table. On the other hand Lakeland Financial Corporation (NASDAQ:LKFN) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Summit Hotel Properties Inc (NYSE:INN) is even less popular than LKFN. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on INN, though not to the same extent, as the stock returned 18.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.