Does Starbucks Corporation (NASDAQ:SBUX) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

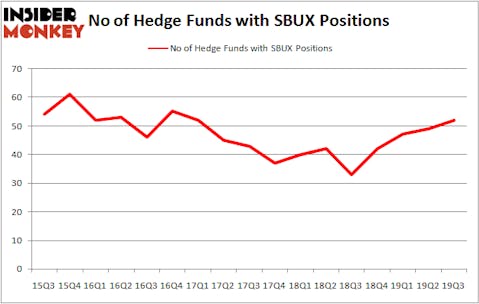

Is Starbucks Corporation (NASDAQ:SBUX) the right pick for your portfolio? Hedge funds are buying. The number of bullish hedge fund positions improved by 3 recently. Our calculations also showed that SBUX isn’t among the 30 most popular stocks among hedge funds (see the video below). SBUX was in 52 hedge funds’ portfolios at the end of September. There were 49 hedge funds in our database with SBUX holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Frank Brosens of Taconic Capital

We’re going to view the new hedge fund action regarding Starbucks Corporation (NASDAQ:SBUX).

What does smart money think about Starbucks Corporation (NASDAQ:SBUX)?

At the end of the third quarter, a total of 52 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from one quarter earlier. On the other hand, there were a total of 33 hedge funds with a bullish position in SBUX a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the biggest position in Starbucks Corporation (NASDAQ:SBUX), worth close to $870.3 million, amounting to 2% of its total 13F portfolio. Sitting at the No. 2 spot is Bill Ackman of Pershing Square, with a $823.5 million position; 13.1% of its 13F portfolio is allocated to the company. Other peers that are bullish include Andy Brown’s Cedar Rock Capital, Renaissance Technologies and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Cedar Rock Capital allocated the biggest weight to Starbucks Corporation (NASDAQ:SBUX), around 18.75% of its portfolio. Pacifica Capital Investments is also relatively very bullish on the stock, designating 17.08 percent of its 13F equity portfolio to SBUX.

Consequently, some big names were leading the bulls’ herd. Junto Capital Management, managed by James Parsons, assembled the biggest position in Starbucks Corporation (NASDAQ:SBUX). Junto Capital Management had $56.5 million invested in the company at the end of the quarter. Frank Brosens’s Taconic Capital also initiated a $13.3 million position during the quarter. The other funds with new positions in the stock are Benjamin A. Smith’s Laurion Capital Management, David Costen Haley’s HBK Investments, and Donald Sussman’s Paloma Partners.

Let’s now review hedge fund activity in other stocks similar to Starbucks Corporation (NASDAQ:SBUX). We will take a look at Linde plc (NYSE:LIN), ASML Holding N.V. (NASDAQ:ASML), Danaher Corporation (NYSE:DHR), and United Parcel Service, Inc. (NYSE:UPS). This group of stocks’ market caps are similar to SBUX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LIN | 44 | 2523402 | 3 |

| ASML | 15 | 774677 | 3 |

| DHR | 57 | 2732120 | -1 |

| UPS | 41 | 1365649 | 5 |

| Average | 39.25 | 1848962 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.25 hedge funds with bullish positions and the average amount invested in these stocks was $1849 million. That figure was $5594 million in SBUX’s case. Danaher Corporation (NYSE:DHR) is the most popular stock in this table. On the other hand ASML Holding N.V. (NASDAQ:ASML) is the least popular one with only 15 bullish hedge fund positions. Starbucks Corporation (NASDAQ:SBUX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately SBUX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SBUX were disappointed as the stock returned -5.6% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.