Does Spirit Realty Capital Inc (NYSE:SRC) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

Spirit Realty Capital Inc (NYSE:SRC) has seen a decrease in enthusiasm from smart money in recent months. Our calculations also showed that src isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are numerous tools investors can use to appraise stocks. Two of the most underrated tools are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the top hedge fund managers can outpace the market by a superb amount (see the details here).

Let’s take a look at the recent hedge fund action regarding Spirit Realty Capital Inc (NYSE:SRC).

Hedge fund activity in Spirit Realty Capital Inc (NYSE:SRC)

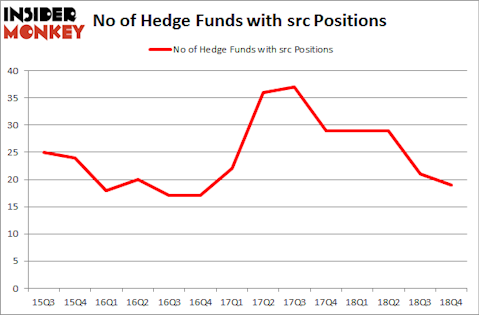

At the end of the fourth quarter, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SRC over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Scopia Capital, managed by Matt Sirovich and Jeremy Mindich, holds the biggest position in Spirit Realty Capital Inc (NYSE:SRC). Scopia Capital has a $69 million position in the stock, comprising 2.3% of its 13F portfolio. The second largest stake is held by Renaissance Technologies, managed by Jim Simons, which holds a $45.4 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining peers with similar optimism include Greg Poole’s Echo Street Capital Management, Ken Griffin’s Citadel Investment Group and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Since Spirit Realty Capital Inc (NYSE:SRC) has experienced falling interest from the smart money, logic holds that there exists a select few hedge funds who sold off their entire stakes in the third quarter. It’s worth mentioning that Tom Wagner and Ara Cohen’s Knighthead Capital cut the largest position of the “upper crust” of funds followed by Insider Monkey, comprising close to $72.8 million in stock. Alex Duran and Scott Hendrickson’s fund, Permian Investment Partners, also said goodbye to its stock, about $36.9 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 2 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Spirit Realty Capital Inc (NYSE:SRC). These stocks are Wolverine World Wide, Inc. (NYSE:WWW), Regal Beloit Corporation (NYSE:RBC), Companhia Siderurgica Nacional (NYSE:SID), and Emergent Biosolutions Inc (NYSE:EBS). All of these stocks’ market caps resemble SRC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WWW | 12 | 84588 | -1 |

| RBC | 17 | 85718 | 0 |

| SID | 7 | 4228 | 0 |

| EBS | 16 | 197098 | 0 |

| Average | 13 | 92908 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $93 million. That figure was $252 million in SRC’s case. Regal Beloit Corporation (NYSE:RBC) is the most popular stock in this table. On the other hand Companhia Siderurgica Nacional (NYSE:SID) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Spirit Realty Capital Inc (NYSE:SRC) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately SRC wasn’t nearly as popular as these 15 stock and hedge funds that were betting on SRC were disappointed as the stock returned 13.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.