Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Southside Bancshares, Inc. (NASDAQ:SBSI)? The smart money sentiment can provide an answer to this question.

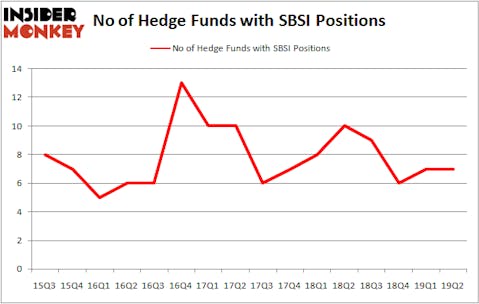

Southside Bancshares, Inc. (NASDAQ:SBSI) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 7 hedge funds’ portfolios at the end of June. At the end of this article we will also compare SBSI to other stocks including First Bancorp (NASDAQ:FBNC), Hess Midstream Partners LP (NYSE:HESM), and Tabula Rasa HealthCare, Inc. (NASDAQ:TRHC) to get a better sense of its popularity. Our calculations also showed that SBSI isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a peek at the fresh hedge fund action surrounding Southside Bancshares, Inc. (NASDAQ:SBSI).

How are hedge funds trading Southside Bancshares, Inc. (NASDAQ:SBSI)?

At the end of the second quarter, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SBSI over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Southside Bancshares, Inc. (NASDAQ:SBSI) was held by Renaissance Technologies, which reported holding $39.9 million worth of stock at the end of March. It was followed by Millennium Management with a $7.1 million position. Other investors bullish on the company included Third Avenue Management, Citadel Investment Group, and D E Shaw.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Winton Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Arrowstreet Capital).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Southside Bancshares, Inc. (NASDAQ:SBSI) but similarly valued. We will take a look at First Bancorp (NASDAQ:FBNC), Hess Midstream Partners LP (NYSE:HESM), Tabula Rasa HealthCare, Inc. (NASDAQ:TRHC), and Golub Capital BDC Inc (NASDAQ:GBDC). This group of stocks’ market values are similar to SBSI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FBNC | 14 | 87532 | -2 |

| HESM | 6 | 9398 | 0 |

| TRHC | 7 | 33253 | 0 |

| GBDC | 8 | 38976 | 0 |

| Average | 8.75 | 42290 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $59 million in SBSI’s case. First Bancorp (NASDAQ:FBNC) is the most popular stock in this table. On the other hand Hess Midstream Partners LP (NYSE:HESM) is the least popular one with only 6 bullish hedge fund positions. Southside Bancshares, Inc. (NASDAQ:SBSI) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on SBSI as the stock returned 6.3% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.