There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Sealed Air Corporation (NYSE:SEE).

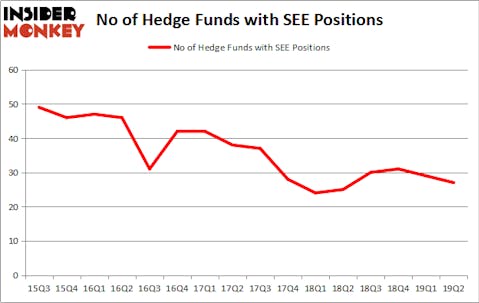

Is Sealed Air Corporation (NYSE:SEE) the right investment to pursue these days? Prominent investors are becoming less confident. The number of bullish hedge fund positions fell by 2 in recent months. Our calculations also showed that SEE isn’t among the 30 most popular stocks among hedge funds (view the video below). SEE was in 27 hedge funds’ portfolios at the end of the second quarter of 2019. There were 29 hedge funds in our database with SEE positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are a lot of metrics stock traders put to use to value publicly traded companies. A couple of the most underrated metrics are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the best investment managers can trounce their index-focused peers by a superb amount (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the latest hedge fund action encompassing Sealed Air Corporation (NYSE:SEE).

What does smart money think about Sealed Air Corporation (NYSE:SEE)?

At the end of the second quarter, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SEE over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Kensico Capital, managed by Michael Lowenstein, holds the number one position in Sealed Air Corporation (NYSE:SEE). Kensico Capital has a $263.3 million position in the stock, comprising 4.8% of its 13F portfolio. On Kensico Capital’s heels is Barry Lebovits and Joshua Kuntz of Rivulet Capital, with a $190 million position; the fund has 19.9% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions comprise Ian Simm’s Impax Asset Management, Israel Englander’s Millennium Management and Seth Rosen’s Nitorum Capital.

Judging by the fact that Sealed Air Corporation (NYSE:SEE) has faced bearish sentiment from hedge fund managers, we can see that there exists a select few hedge funds that decided to sell off their entire stakes heading into Q3. It’s worth mentioning that Ken Griffin’s Citadel Investment Group sold off the biggest stake of the 750 funds tracked by Insider Monkey, totaling an estimated $22.4 million in stock. Jeffrey Talpins’s fund, Element Capital Management, also dumped its stock, about $10 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 2 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to Sealed Air Corporation (NYSE:SEE). We will take a look at Five Below Inc (NASDAQ:FIVE), Proofpoint Inc (NASDAQ:PFPT), SL Green Realty Corp (NYSE:SLG), and HD Supply Holdings Inc (NASDAQ:HDS). This group of stocks’ market values are similar to SEE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FIVE | 38 | 550414 | 0 |

| PFPT | 36 | 566584 | 3 |

| SLG | 15 | 276468 | -4 |

| HDS | 30 | 893946 | 0 |

| Average | 29.75 | 571853 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $572 million. That figure was $1010 million in SEE’s case. Five Below Inc (NASDAQ:FIVE) is the most popular stock in this table. On the other hand SL Green Realty Corp (NYSE:SLG) is the least popular one with only 15 bullish hedge fund positions. Sealed Air Corporation (NYSE:SEE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately SEE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); SEE investors were disappointed as the stock returned -2.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.