In this article we are going to use hedge fund sentiment as a tool and determine whether Signature Bank (NASDAQ:SBNY) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

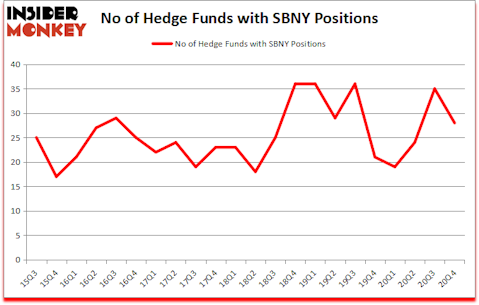

Is SBNY stock a buy? Signature Bank (NASDAQ:SBNY) investors should be aware of a decrease in support from the world’s most elite money managers of late. Signature Bank (NASDAQ:SBNY) was in 28 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 36. There were 35 hedge funds in our database with SBNY holdings at the end of September. Our calculations also showed that SBNY isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Matthew Lindenbaum of Basswood Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, auto parts business is a recession resistant business, so we are taking a closer look at this discount auto parts stock that is growing at a 196% annualized rate. We go through lists like the 15 best micro-cap stocks to buy now to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s check out the new hedge fund action encompassing Signature Bank (NASDAQ:SBNY).

Do Hedge Funds Think SBNY Is A Good Stock To Buy Now?

At the end of December, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -20% from the third quarter of 2020. The graph below displays the number of hedge funds with bullish position in SBNY over the last 22 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in Signature Bank (NASDAQ:SBNY), which was worth $134 million at the end of the fourth quarter. On the second spot was First Pacific Advisors LLC which amassed $126.9 million worth of shares. Junto Capital Management, Basswood Capital, and Royce & Associates were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Elizabeth Park Capital Management allocated the biggest weight to Signature Bank (NASDAQ:SBNY), around 3.52% of its 13F portfolio. Second Curve Capital is also relatively very bullish on the stock, dishing out 2.82 percent of its 13F equity portfolio to SBNY.

Seeing as Signature Bank (NASDAQ:SBNY) has faced a decline in interest from the smart money, we can see that there lies a certain “tier” of hedge funds who sold off their entire stakes in the fourth quarter. Interestingly, Anand Parekh’s Alyeska Investment Group dumped the largest investment of the 750 funds monitored by Insider Monkey, worth about $18.2 million in stock, and Gregg Moskowitz’s Interval Partners was right behind this move, as the fund said goodbye to about $3.2 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 7 funds in the fourth quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Signature Bank (NASDAQ:SBNY) but similarly valued. We will take a look at East West Bancorp, Inc. (NASDAQ:EWBC), The Middleby Corporation (NASDAQ:MIDD), TG Therapeutics Inc (NASDAQ:TGTX), Lumentum Holdings Inc (NASDAQ:LITE), Vornado Realty Trust (NYSE:VNO), Ares Capital Corporation (NASDAQ:ARCC), and Zions Bancorporation, National Association (NASDAQ:ZION). All of these stocks’ market caps resemble SBNY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EWBC | 24 | 403705 | 4 |

| MIDD | 30 | 313117 | 0 |

| TGTX | 38 | 1311739 | 8 |

| LITE | 39 | 545949 | -1 |

| VNO | 23 | 178548 | 3 |

| ARCC | 15 | 102905 | -7 |

| ZION | 28 | 169688 | 4 |

| Average | 28.1 | 432236 | 1.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.1 hedge funds with bullish positions and the average amount invested in these stocks was $432 million. That figure was $571 million in SBNY’s case. Lumentum Holdings Inc (NASDAQ:LITE) is the most popular stock in this table. On the other hand Ares Capital Corporation (NASDAQ:ARCC) is the least popular one with only 15 bullish hedge fund positions. Signature Bank (NASDAQ:SBNY) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for SBNY is 48.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 12.3% in 2021 through April 19th and still beat the market by 0.9 percentage points. A small number of hedge funds were also right about betting on SBNY as the stock returned 69% since the end of the fourth quarter (through 4/19) and outperformed the market by an even larger margin.

Follow Signature Bank New York N Y (OTC:SBNY)

Follow Signature Bank New York N Y (OTC:SBNY)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.