Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Is Sally Beauty Holdings, Inc. (NYSE:SBH) worth your attention right now? Investors who are in the know are turning bullish. The number of long hedge fund bets increased by 1 lately. Our calculations also showed that SBH isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to check out the latest hedge fund action regarding Sally Beauty Holdings, Inc. (NYSE:SBH).

How have hedgies been trading Sally Beauty Holdings, Inc. (NYSE:SBH)?

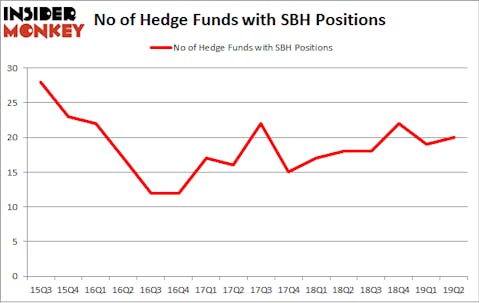

Heading into the third quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in SBH over the last 16 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

More specifically, Arrowstreet Capital was the largest shareholder of Sally Beauty Holdings, Inc. (NYSE:SBH), with a stake worth $37 million reported as of the end of March. Trailing Arrowstreet Capital was AQR Capital Management, which amassed a stake valued at $28.2 million. D E Shaw, GAMCO Investors, and Samlyn Capital were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key hedge funds have jumped into Sally Beauty Holdings, Inc. (NYSE:SBH) headfirst. Samlyn Capital, managed by Robert Pohly, established the biggest position in Sally Beauty Holdings, Inc. (NYSE:SBH). Samlyn Capital had $3.6 million invested in the company at the end of the quarter. Anthony Joseph Vaccarino’s North Fourth Asset Management also initiated a $1.7 million position during the quarter. The following funds were also among the new SBH investors: Michael Gelband’s ExodusPoint Capital, Mike Vranos’s Ellington, and Matthew Tewksbury’s Stevens Capital Management.

Let’s go over hedge fund activity in other stocks similar to Sally Beauty Holdings, Inc. (NYSE:SBH). We will take a look at RPC, Inc. (NYSE:RES), First Busey Corporation (NASDAQ:BUSE), Brinker International, Inc. (NYSE:EAT), and Kulicke and Soffa Industries Inc. (NASDAQ:KLIC). This group of stocks’ market caps resemble SBH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RES | 16 | 83837 | -4 |

| BUSE | 11 | 42651 | -2 |

| EAT | 28 | 238224 | -1 |

| KLIC | 17 | 229037 | 0 |

| Average | 18 | 148437 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $148 million. That figure was $118 million in SBH’s case. Brinker International, Inc. (NYSE:EAT) is the most popular stock in this table. On the other hand First Busey Corporation (NASDAQ:BUSE) is the least popular one with only 11 bullish hedge fund positions. Sally Beauty Holdings, Inc. (NYSE:SBH) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on SBH as the stock returned 11.6% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.