We at Insider Monkey have gone over 738 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of Royal Gold, Inc (NASDAQ:RGLD) based on that data.

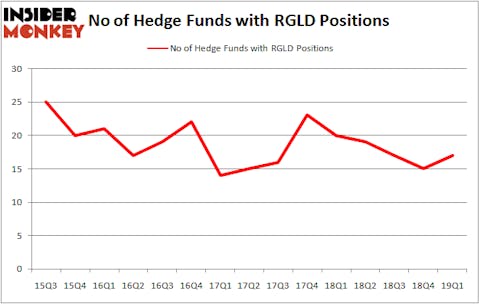

Royal Gold, Inc (NASDAQ:RGLD) investors should pay attention to an increase in support from the world’s most elite money managers lately. Our calculations also showed that RGLD isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the new hedge fund action surrounding Royal Gold, Inc (NASDAQ:RGLD).

How have hedgies been trading Royal Gold, Inc (NASDAQ:RGLD)?

Heading into the second quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from one quarter earlier. By comparison, 20 hedge funds held shares or bullish call options in RGLD a year ago. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Murray Stahl’s Horizon Asset Management has the number one position in Royal Gold, Inc (NASDAQ:RGLD), worth close to $22.7 million, corresponding to 0.6% of its total 13F portfolio. The second largest stake is held by Hudson Bay Capital Management, managed by Sander Gerber, which holds a $16.2 million call position; 0.2% of its 13F portfolio is allocated to the company. Other professional money managers that hold long positions comprise Ken Griffin’s Citadel Investment Group, Cliff Asness’s AQR Capital Management and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Now, key hedge funds were leading the bulls’ herd. Arrowgrass Capital Partners, managed by Nick Niell, assembled the biggest position in Royal Gold, Inc (NASDAQ:RGLD). Arrowgrass Capital Partners had $22.2 million invested in the company at the end of the quarter. Sander Gerber’s Hudson Bay Capital Management also made a $16.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Ken Griffin’s Citadel Investment Group, David Harding’s Winton Capital Management, and Charles Davidson and Joseph Jacobs’s Wexford Capital.

Let’s go over hedge fund activity in other stocks similar to Royal Gold, Inc (NASDAQ:RGLD). We will take a look at Axalta Coating Systems Ltd (NYSE:AXTA), Flowserve Corporation (NYSE:FLS), Catalent Inc (NYSE:CTLT), and Cree, Inc. (NASDAQ:CREE). This group of stocks’ market valuations are similar to RGLD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AXTA | 43 | 1962919 | 8 |

| FLS | 20 | 235664 | 4 |

| CTLT | 15 | 145810 | -4 |

| CREE | 14 | 88463 | 5 |

| Average | 23 | 608214 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $608 million. That figure was $67 million in RGLD’s case. Axalta Coating Systems Ltd (NYSE:AXTA) is the most popular stock in this table. On the other hand Cree, Inc. (NASDAQ:CREE) is the least popular one with only 14 bullish hedge fund positions. Royal Gold, Inc (NASDAQ:RGLD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on RGLD as the stock returned 8.2% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.