The market has been volatile as the Federal Reserve continues its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points through November 16th. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Royal Gold, Inc. (NASDAQ:RGLD) and find out how it is affected by hedge funds’ moves.

Is Royal Gold, Inc. (NASDAQ:RGLD) an outstanding investment now? Prominent investors are getting less optimistic. The number of bullish hedge fund positions were cut by 2 lately.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

While collecting data for this article, we tracked down the opinion of ClearBridge Value Trust, a fund that is long on the stock. In its 3rd Quarter Shareholder Letter, the fund said this:

“Royal Gold (RGLD), in the materials sector, is a worldwide precious metal streaming and royalty company. The combination of recent strength in the U.S. dollar and higher interest rates and Treasury yields lowered precious metal prices and held back margins for Royal Gold. The company remains extremely cash-flow generative and has raised its dividend now 17 years in a row.”

We’re going to take a look at the new hedge fund action surrounding Royal Gold, Inc. (NASDAQ:RGLD).

Hedge fund activity in Royal Gold, Inc. (NASDAQ:RGLD)

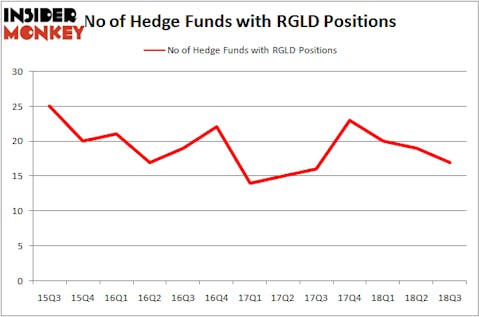

Heading into the fourth quarter of 2018, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -11% from one quarter earlier. By comparison, 23 hedge funds held shares or bullish call options in RGLD heading into this year. Considering the bearishness for the stock, it’s not surprising that Royal Gold wasn’t one of the 30 most popular stocks among hedge funds.

So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Horizon Asset Management held the most valuable stake in Royal Gold, Inc. (NASDAQ:RGLD), which was worth $21.5 million at the end of the third quarter. On the second spot was Millennium Management which amassed $16.5 million worth of shares. Moreover, Citadel Investment Group, PEAK6 Capital Management, and Citadel Investment Group were also bullish on Royal Gold, Inc. (NASDAQ:RGLD), allocating a large percentage of their portfolios to this stock.

Seeing as Royal Gold, Inc. (NASDAQ:RGLD) has experienced declining sentiment from the smart money, it’s safe to say that there were a few hedge funds that elected to cut their entire stakes by the end of the third quarter. At the top of the heap, Daniel S. Och’s OZ Management said goodbye to the largest position of the 700 funds monitored by Insider Monkey, worth close to $7.4 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund dropped about $1.4 million worth. These moves are important to note, as aggregate hedge fund interest fell by 2 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Royal Gold, Inc. (NASDAQ:RGLD) but similarly valued. These stocks are Cable One Inc (NYSE:CABO), Empire State Realty Trust Inc (NYSE:ESRT), MDU Resources Group Inc (NYSE:MDU), and Pivotal Software, Inc. (NYSE:PVTL). This group of stocks’ market valuations match RGLD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CABO | 18 | 628986 | 0 |

| ESRT | 13 | 223977 | -4 |

| MDU | 19 | 171020 | 4 |

| PVTL | 18 | 314199 | -3 |

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $335 million. That figure was $79 million in RGLD’s case. MDU Resources Group Inc (NYSE:MDU) is the most popular stock in this table. On the other hand Empire State Realty Trust Inc (NYSE:ESRT) is the least popular one with only 13 bullish hedge fund positions. Royal Gold, Inc. (NASDAQ:RGLD) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MDU might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.