A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Ritchie Bros. Auctioneers Incorporated (NYSE:RBA).

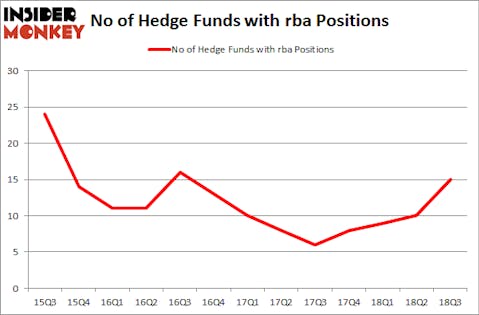

Is Ritchie Bros. Auctioneers Incorporated (NYSE:RBA) a bargain? Prominent investors are turning bullish. The number of long hedge fund positions rose by 5 lately. Our calculations also showed that rba isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s go over the latest hedge fund action encompassing Ritchie Bros. Auctioneers Incorporated (NYSE:RBA).

How have hedgies been trading Ritchie Bros. Auctioneers Incorporated (NYSE:RBA)?

At the end of the third quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from the second quarter of 2018. On the other hand, there were a total of 8 hedge funds with a bullish position in RBA at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Ritchie Bros. Auctioneers Incorporated (NYSE:RBA) was held by Royce & Associates, which reported holding $61.7 million worth of stock at the end of September. It was followed by D E Shaw with a $16.8 million position. Other investors bullish on the company included Arrowstreet Capital, Citadel Investment Group, and Millennium Management.

As industrywide interest jumped, key money managers have jumped into Ritchie Bros. Auctioneers Incorporated (NYSE:RBA) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the largest position in Ritchie Bros. Auctioneers Incorporated (NYSE:RBA). Arrowstreet Capital had $8.6 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also initiated a $5.5 million position during the quarter. The other funds with new positions in the stock are John Overdeck and David Siegel’s Two Sigma Advisors, Matthew Tewksbury’s Stevens Capital Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Ritchie Bros. Auctioneers Incorporated (NYSE:RBA) but similarly valued. We will take a look at Versum Materials, Inc. (NYSE:VSM), Equity Commonwealth (NYSE:EQC), Mellanox Technologies, Ltd. (NASDAQ:MLNX), and Immunomedics, Inc. (NASDAQ:IMMU). This group of stocks’ market values are closest to RBA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VSM | 21 | 543083 | 4 |

| EQC | 17 | 297467 | -7 |

| MLNX | 32 | 846212 | -4 |

| IMMU | 30 | 944645 | -3 |

| Average | 25 | 657852 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $658 million. That figure was $118 million in RBA’s case. Mellanox Technologies, Ltd. (NASDAQ:MLNX) is the most popular stock in this table. On the other hand Equity Commonwealth (NYSE:EQC) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Ritchie Bros. Auctioneers Incorporated (NYSE:RBA) is even less popular than EQC. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.