It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 7% during October and average hedge fund losing about 3%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by about 4 percentage points during the first half of Q4, as investors fled less-known quantities for safe havens. This was the case with hedge funds, who we heard were pulling money from the market amid the volatility, which included money from small-cap stocks, which they invest in at a higher rate than other investors. This action contributed to the greater decline in these stocks during the tumultuous period. We will study how this market volatility affected their sentiment towards Rexnord Corp (NYSE:RXN) during the quarter below.

Is Rexnord Corp (NYSE:RXN) a marvelous investment today? Investors who are in the know are taking a bearish view. The number of bullish hedge fund positions decreased by 1 lately. Our calculations also showed that rxn isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s check out the latest hedge fund action surrounding Rexnord Corp (NYSE:RXN).

How are hedge funds trading Rexnord Corp (NYSE:RXN)?

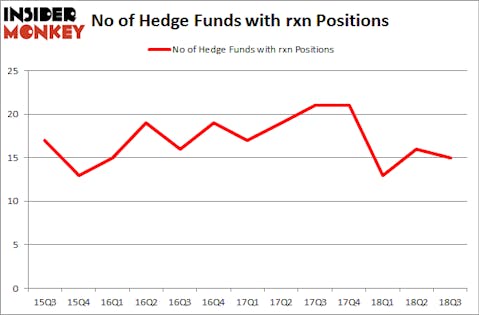

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards RXN over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Impax Asset Management held the most valuable stake in Rexnord Corp (NYSE:RXN), which was worth $103 million at the end of the third quarter. On the second spot was D E Shaw which amassed $19.1 million worth of shares. Moreover, Renaissance Technologies, Millennium Management, and GLG Partners were also bullish on Rexnord Corp (NYSE:RXN), allocating a large percentage of their portfolios to this stock.

Due to the fact that Rexnord Corp (NYSE:RXN) has faced declining sentiment from the smart money, we can see that there exists a select few funds that slashed their entire stakes in the third quarter. It’s worth mentioning that Phill Gross and Robert Atchinson’s Adage Capital Management sold off the largest position of all the hedgies watched by Insider Monkey, comprising about $30.3 million in stock, and Gregg Moskowitz’s Interval Partners was right behind this move, as the fund sold off about $7.7 million worth. These moves are important to note, as total hedge fund interest was cut by 1 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Rexnord Corp (NYSE:RXN) but similarly valued. We will take a look at Hilton Grand Vacations Inc. (NYSE:HGV), Smartsheet Inc. (NYSE:SMAR), Spirit Airlines Incorporated (NYSE:SAVE), and CommVault Systems, Inc. (NASDAQ:CVLT). All of these stocks’ market caps resemble RXN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HGV | 27 | 587168 | 4 |

| SMAR | 11 | 102729 | 0 |

| SAVE | 20 | 374621 | 3 |

| CVLT | 22 | 412540 | -1 |

| Average | 20 | 369265 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $369 million. That figure was $170 million in RXN’s case. Hilton Grand Vacations Inc. (NYSE:HGV) is the most popular stock in this table. On the other hand Smartsheet Inc. (NYSE:SMAR) is the least popular one with only 11 bullish hedge fund positions. Rexnord Corp (NYSE:RXN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HGV might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.