A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Resolute Forest Products Inc (NYSE:RFP).

The hedge fund interest towards Resolute Forest Products Inc (NYSE:RFP) remained unchanged last quarter. This is usually a negative indicator, although the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Textainer Group Holdings Limited (NYSE:TGH), Ladenburg Thalmann Financial Services (NYSEAMEX:LTS), and Gener8 Maritime Inc (NYSE:GNRT) to gather more data points.

Follow Resolute Forest Products Inc. (NYSE:RFP)

Follow Resolute Forest Products Inc. (NYSE:RFP)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Julia Ivantsova/Shutterstock.com

With all of this in mind, we’re going to review the latest action regarding Resolute Forest Products Inc (NYSE:RFP).

How have hedgies been trading Resolute Forest Products Inc (NYSE:RFP)?

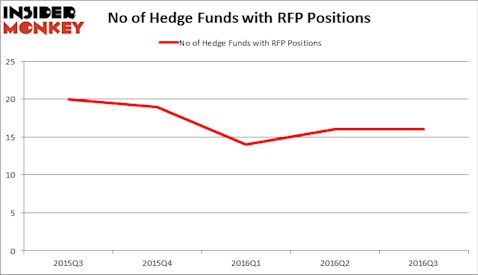

At the end of September, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in Resolute Forest Products Inc (NYSE:RFP), flat over the quarter. By comparison, 19 hedge funds held shares or bullish call options in RFP heading into this year. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Fairfax Financial Holdings, led by Prem Watsa, holds the largest position in Resolute Forest Products Inc (NYSE:RFP). Fairfax Financial Holdings has a $144.2 million position in the stock, comprising 13% of its 13F portfolio. The second most bullish fund is Francis Chou’s Chou Associates Management, with a $23.2 million position; 8.6% of its 13F portfolio is allocated to the stock. Remaining members of the smart money with similar optimism comprise Michael Johnston’s Steelhead Partners, Jim Simons’s Renaissance Technologies, and Scott Wallace’s Wallace Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.