In this article we will take a look at whether hedge funds think Royal Caribbean Cruises Ltd. (NYSE:RCL) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

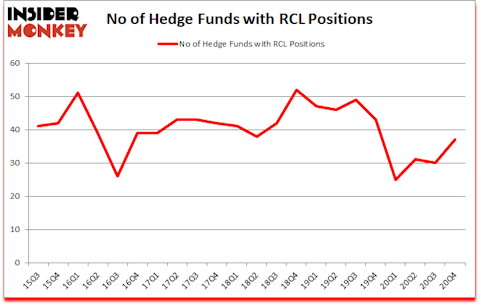

Is RCL stock a buy? Prominent investors were getting more optimistic. The number of bullish hedge fund positions advanced by 7 recently. Royal Caribbean Cruises Ltd. (NYSE:RCL) was in 37 hedge funds’ portfolios at the end of December. The all time high for this statistic is 52. Our calculations also showed that RCL isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

At the moment there are numerous formulas stock traders use to appraise stocks. Some of the most useful formulas are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the top investment managers can outpace their index-focused peers by a superb amount (see the details here).

Ian Wace of Marshall Wace

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to take a gander at the recent hedge fund action encompassing Royal Caribbean Cruises Ltd. (NYSE:RCL).

Do Hedge Funds Think RCL Is A Good Stock To Buy Now?

At fourth quarter’s end, a total of 37 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 23% from the third quarter of 2020. By comparison, 43 hedge funds held shares or bullish call options in RCL a year ago. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

More specifically, D E Shaw was the largest shareholder of Royal Caribbean Cruises Ltd. (NYSE:RCL), with a stake worth $150.5 million reported as of the end of December. Trailing D E Shaw was Marshall Wace LLP, which amassed a stake valued at $81.2 million. Shannon River Fund Management, Citadel Investment Group, and Ariel Investments were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Proem Advisors allocated the biggest weight to Royal Caribbean Cruises Ltd. (NYSE:RCL), around 4.63% of its 13F portfolio. Shannon River Fund Management is also relatively very bullish on the stock, dishing out 4.26 percent of its 13F equity portfolio to RCL.

Now, specific money managers were leading the bulls’ herd. Shannon River Fund Management, managed by Spencer M. Waxman, assembled the largest position in Royal Caribbean Cruises Ltd. (NYSE:RCL). Shannon River Fund Management had $45.4 million invested in the company at the end of the quarter. Michael Hintze’s CQS Cayman LP also made a $23.7 million investment in the stock during the quarter. The following funds were also among the new RCL investors: John Overdeck and David Siegel’s Two Sigma Advisors, Anthony Joseph Vaccarino’s North Fourth Asset Management, and Imran Khan’s Proem Advisors.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Royal Caribbean Cruises Ltd. (NYSE:RCL) but similarly valued. We will take a look at United Rentals, Inc. (NYSE:URI), Halliburton Company (NYSE:HAL), Trimble Inc. (NASDAQ:TRMB), Zendesk Inc (NYSE:ZEN), Energy Transfer L.P. (NYSE:ET), HEICO Corporation (NYSE:HEI), and Invitation Homes Inc. (NYSE:INVH). All of these stocks’ market caps match RCL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| URI | 46 | 1060784 | 6 |

| HAL | 31 | 1027399 | -1 |

| TRMB | 21 | 1330232 | -14 |

| ZEN | 58 | 1858196 | -1 |

| ET | 25 | 543271 | -6 |

| HEI | 44 | 786027 | 1 |

| INVH | 27 | 833637 | -1 |

| Average | 36 | 1062792 | -2.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36 hedge funds with bullish positions and the average amount invested in these stocks was $1063 million. That figure was $554 million in RCL’s case. Zendesk Inc (NYSE:ZEN) is the most popular stock in this table. On the other hand Trimble Inc. (NASDAQ:TRMB) is the least popular one with only 21 bullish hedge fund positions. Royal Caribbean Cruises Ltd. (NYSE:RCL) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for RCL is 53. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 7.9% in 2021 through April 1st and still beat the market by 0.4 percentage points. Hedge funds were also right about betting on RCL as the stock returned 16% since the end of Q4 (through 4/1) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Royal Caribbean Cruises Ltd (NYSE:RCL)

Follow Royal Caribbean Cruises Ltd (NYSE:RCL)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.