In this article we will check out the progression of hedge fund sentiment towards Pure Storage, Inc. (NYSE:PSTG) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

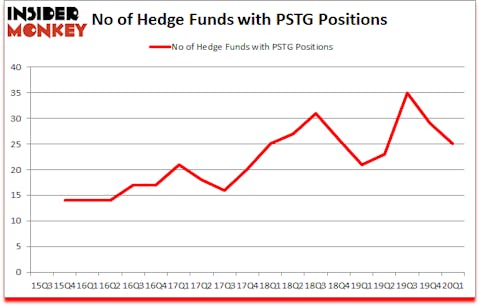

Pure Storage, Inc. (NYSE:PSTG) investors should pay attention to a decrease in support from the world’s most elite money managers in recent months. Our calculations also showed that PSTG isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

J. Carlo Cannell of Cannell Capital

We leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like these. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to take a glance at the recent hedge fund action encompassing Pure Storage, Inc. (NYSE:PSTG).

What does smart money think about Pure Storage, Inc. (NYSE:PSTG)?

Heading into the second quarter of 2020, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PSTG over the last 18 quarters. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Ricky Sandler’s Eminence Capital has the number one position in Pure Storage, Inc. (NYSE:PSTG), worth close to $174.4 million, amounting to 1.9% of its total 13F portfolio. Sitting at the No. 2 spot is D E Shaw, led by D. E. Shaw, holding a $35.6 million position; 0.1% of its 13F portfolio is allocated to the company. Remaining members of the smart money that hold long positions comprise Renaissance Technologies, Ken Griffin’s Citadel Investment Group and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Cannell Capital allocated the biggest weight to Pure Storage, Inc. (NYSE:PSTG), around 2.46% of its 13F portfolio. Eminence Capital is also relatively very bullish on the stock, designating 1.91 percent of its 13F equity portfolio to PSTG.

Seeing as Pure Storage, Inc. (NYSE:PSTG) has witnessed a decline in interest from the entirety of the hedge funds we track, we can see that there exists a select few money managers that elected to cut their positions entirely last quarter. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP dropped the biggest investment of the “upper crust” of funds tracked by Insider Monkey, worth an estimated $5.6 million in stock. Richard SchimeláandáLawrence Sapanski’s fund, Cinctive Capital Management, also cut its stock, about $5.5 million worth. These moves are important to note, as total hedge fund interest was cut by 4 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Pure Storage, Inc. (NYSE:PSTG). These stocks are FirstService Corporation (TSE:FSV), Silgan Holdings Inc. (NASDAQ:SLGN), The Middleby Corporation (NASDAQ:MIDD), and Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA). This group of stocks’ market values are closest to PSTG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FSV | 12 | 137025 | 0 |

| SLGN | 16 | 176587 | -1 |

| MIDD | 26 | 85040 | -9 |

| MNTA | 36 | 666857 | 3 |

| Average | 22.5 | 266377 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $266 million. That figure was $321 million in PSTG’s case. Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA) is the most popular stock in this table. On the other hand FirstService Corporation (TSE:FSV) is the least popular one with only 12 bullish hedge fund positions. Pure Storage, Inc. (NYSE:PSTG) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.9% in 2020 through June 10th but still beat the market by 14.2 percentage points. Hedge funds were also right about betting on PSTG as the stock returned 38.6% in Q2 (through June 10th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Pure Storage Inc. (NYSE:PSTG)

Follow Pure Storage Inc. (NYSE:PSTG)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.