You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

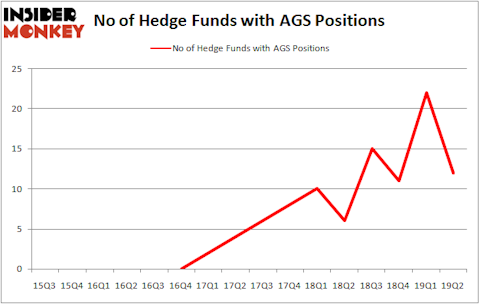

PlayAGS, Inc. (NYSE:AGS) was in 12 hedge funds’ portfolios at the end of the second quarter of 2019. AGS shareholders have witnessed a decrease in enthusiasm from smart money of late. There were 22 hedge funds in our database with AGS holdings at the end of the previous quarter. Our calculations also showed that AGS isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most investors, hedge funds are assumed to be unimportant, outdated financial tools of yesteryear. While there are more than 8000 funds with their doors open at the moment, Our researchers look at the masters of this group, about 750 funds. These hedge fund managers preside over most of all hedge funds’ total capital, and by monitoring their highest performing investments, Insider Monkey has found a number of investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the new hedge fund action regarding PlayAGS, Inc. (NYSE:AGS).

What have hedge funds been doing with PlayAGS, Inc. (NYSE:AGS)?

Heading into the third quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -45% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards AGS over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Park West Asset Management, managed by Peter S. Park, holds the largest position in PlayAGS, Inc. (NYSE:AGS). Park West Asset Management has a $45.7 million position in the stock, comprising 1.9% of its 13F portfolio. Sitting at the No. 2 spot is Marshall Wace LLP, managed by Paul Marshall and Ian Wace, which holds a $9.3 million position; 0.1% of its 13F portfolio is allocated to the company. Some other members of the smart money with similar optimism encompass Elise Di Vincenzo Crumbine’s Stormborn Capital Management, Ken Grossman and Glen Schneider’s SG Capital Management and Israel Englander’s Millennium Management.

Since PlayAGS, Inc. (NYSE:AGS) has faced falling interest from hedge fund managers, it’s easy to see that there lies a certain “tier” of funds that decided to sell off their full holdings by the end of the second quarter. At the top of the heap, Richard Driehaus’s Driehaus Capital sold off the biggest investment of the “upper crust” of funds tracked by Insider Monkey, totaling an estimated $11.8 million in stock, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital was right behind this move, as the fund dumped about $4.1 million worth. These transactions are interesting, as aggregate hedge fund interest was cut by 10 funds by the end of the second quarter.

Let’s check out hedge fund activity in other stocks similar to PlayAGS, Inc. (NYSE:AGS). We will take a look at Comtech Telecommunications Corp. (NASDAQ:CMTL), Personalis, Inc. (NASDAQ:PSNL), Cass Information Systems, Inc. (NASDAQ:CASS), and Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH). This group of stocks’ market caps match AGS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMTL | 17 | 106760 | -3 |

| PSNL | 17 | 83879 | 17 |

| CASS | 11 | 20185 | 0 |

| RUTH | 16 | 54849 | 1 |

| Average | 15.25 | 66418 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $66 million. That figure was $82 million in AGS’s case. Comtech Telecommunications Corp. (NASDAQ:CMTL) is the most popular stock in this table. On the other hand Cass Information Systems, Inc. (NASDAQ:CASS) is the least popular one with only 11 bullish hedge fund positions. PlayAGS, Inc. (NYSE:AGS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately AGS wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); AGS investors were disappointed as the stock returned -47.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.