World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

Petmed Express Inc (NASDAQ:PETS) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 18 hedge funds’ portfolios at the end of September. At the end of this article we will also compare PETS to other stocks including Urstadt Biddle Properties Inc. (NYSE:UBP), Lindblad Expeditions Holdings Inc (NASDAQ:LIND), and Veritex Holdings Inc (NASDAQ:VBTX) to get a better sense of its popularity.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the latest hedge fund action regarding Petmed Express Inc (NASDAQ:PETS).

How are hedge funds trading Petmed Express Inc (NASDAQ:PETS)?

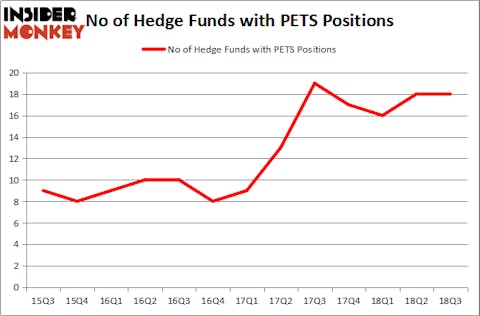

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, no change from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in PETS over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Petmed Express Inc (NASDAQ:PETS), with a stake worth $57.7 million reported as of the end of September. Trailing Renaissance Technologies was Armistice Capital, which amassed a stake valued at $17.6 million. Citadel Investment Group, Millennium Management, and GLG Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Because Petmed Express Inc (NASDAQ:PETS) has witnessed declining sentiment from the smart money, logic holds that there were a few money managers who sold off their entire stakes in the third quarter. It’s worth mentioning that Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the biggest investment of the 700 funds watched by Insider Monkey, worth about $14.2 million in stock, and Noah Levy and Eugene Dozortsev’s Newtyn Management was right behind this move, as the fund sold off about $12.1 million worth. These transactions are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Petmed Express Inc (NASDAQ:PETS) but similarly valued. We will take a look at Urstadt Biddle Properties Inc. (NYSE:UBP), Lindblad Expeditions Holdings Inc (NASDAQ:LIND), Veritex Holdings Inc (NASDAQ:VBTX), and Primo Water Corporation (NASDAQ:PRMW). All of these stocks’ market caps match PETS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UBP | 2 | 12301 | 0 |

| LIND | 14 | 92209 | -2 |

| VBTX | 17 | 91770 | 5 |

| PRMW | 16 | 176434 | -1 |

| Average | 12.25 | 93179 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $93 million. That figure was $137 million in PETS’s case. Veritex Holdings Inc (NASDAQ:VBTX) is the most popular stock in this table. On the other hand Urstadt Biddle Properties Inc. (NYSE:UBP) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Petmed Express Inc (NASDAQ:PETS) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.