Before we spend countless hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Pacira Pharmaceuticals Inc (NASDAQ:PCRX).

Hedge fund interest in Pacira Pharmaceuticals Inc (NASDAQ:PCRX) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare PCRX to other stocks including Mack Cali Realty Corp (NYSE:CLI), Opko Health Inc. (NYSE:OPK), and Kosmos Energy Ltd (NYSE:KOS) to get a better sense of its popularity.

At the moment there are a multitude of methods stock traders put to use to grade publicly traded companies. Two of the less utilized methods are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can beat their index-focused peers by a solid margin (see the details here).

Let’s view the new hedge fund action surrounding Pacira Pharmaceuticals Inc (NASDAQ:PCRX).

How have hedgies been trading Pacira Pharmaceuticals Inc (NASDAQ:PCRX)?

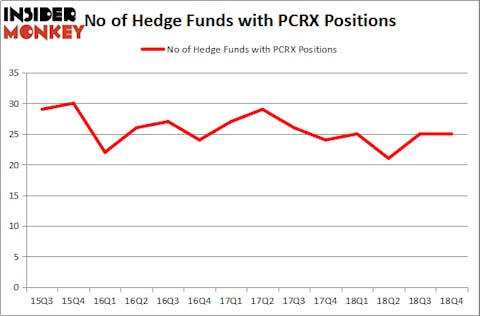

At the end of the fourth quarter, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in PCRX over the last 14 quarters. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Consonance Capital Management, managed by Mitchell Blutt, holds the most valuable position in Pacira Pharmaceuticals Inc (NASDAQ:PCRX). Consonance Capital Management has a $157.1 million position in the stock, comprising 11.6% of its 13F portfolio. On Consonance Capital Management’s heels is Arthur B Cohen and Joseph Healey of Healthcor Management LP, with a $91.5 million position; the fund has 2.9% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism include Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, Israel Englander’s Millennium Management and Steve Cohen’s Point72 Asset Management.

Because Pacira Pharmaceuticals Inc (NASDAQ:PCRX) has experienced declining sentiment from the entirety of the hedge funds we track, logic holds that there exists a select few money managers that slashed their full holdings in the third quarter. Interestingly, Zach Schreiber’s Point State Capital sold off the largest investment of the 700 funds tracked by Insider Monkey, valued at close to $12.6 million in stock, and Justin John Ferayorni’s Tamarack Capital Management was right behind this move, as the fund said goodbye to about $7.4 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Pacira Pharmaceuticals Inc (NASDAQ:PCRX) but similarly valued. We will take a look at Mack Cali Realty Corp (NYSE:CLI), Opko Health Inc. (NASDAQ:OPK), Kosmos Energy Ltd (NYSE:KOS), and Innoviva, Inc. (NASDAQ:INVA). This group of stocks’ market values are similar to PCRX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CLI | 9 | 115323 | -2 |

| OPK | 15 | 5892 | 1 |

| KOS | 14 | 107311 | -4 |

| INVA | 22 | 311564 | 0 |

| Average | 15 | 135023 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $135 million. That figure was $541 million in PCRX’s case. Innoviva, Inc. (NASDAQ:INVA) is the most popular stock in this table. On the other hand Mack Cali Realty Corp (NYSE:CLI) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Pacira Pharmaceuticals Inc (NASDAQ:PCRX) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately PCRX wasn’t nearly as popular as these 15 stock and hedge funds that were betting on PCRX were disappointed as the stock returned -9.9% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.