It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 15 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 19.7% during the first 2.5 months of 2019 (vs. 13.1% gain for SPY), with 93% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in One Liberty Properties, Inc. (NYSE:OLP).

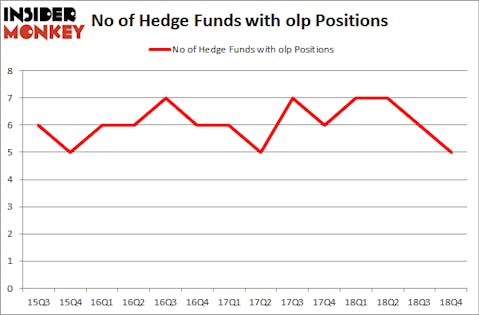

Is One Liberty Properties, Inc. (NYSE:OLP) a buy right now? The smart money is becoming less hopeful. The number of bullish hedge fund bets fell by 1 recently. Our calculations also showed that olp isn’t among the 30 most popular stocks among hedge funds.

To most investors, hedge funds are viewed as unimportant, outdated investment vehicles of years past. While there are greater than 8000 funds with their doors open at the moment, Our researchers hone in on the aristocrats of this club, around 750 funds. Most estimates calculate that this group of people orchestrate bulk of all hedge funds’ total capital, and by shadowing their inimitable equity investments, Insider Monkey has identified several investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to review the fresh hedge fund action regarding One Liberty Properties, Inc. (NYSE:OLP).

What have hedge funds been doing with One Liberty Properties, Inc. (NYSE:OLP)?

At the end of the fourth quarter, a total of 5 of the hedge funds tracked by Insider Monkey were long this stock, a change of -17% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards OLP over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of One Liberty Properties, Inc. (NYSE:OLP), with a stake worth $20.7 million reported as of the end of December. Trailing Renaissance Technologies was Two Sigma Advisors, which amassed a stake valued at $0.7 million. Millennium Management, Bailard Inc, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: PEAK6 Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 700+ hedge funds tracked by Insider Monkey identified OLP as a viable investment and initiated a position in the stock.

Let’s also examine hedge fund activity in other stocks similar to One Liberty Properties, Inc. (NYSE:OLP). We will take a look at Zymeworks Inc. (NYSE:ZYME), Mercantile Bank Corp. (NASDAQ:MBWM), CymaBay Therapeutics Inc (NASDAQ:CBAY), and Front Yard Residential Corporation (NYSE:RESI). This group of stocks’ market values resemble OLP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZYME | 11 | 103481 | -2 |

| MBWM | 6 | 24700 | -2 |

| CBAY | 27 | 186903 | 4 |

| RESI | 13 | 24911 | -2 |

| Average | 14.25 | 84999 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $85 million. That figure was $22 million in OLP’s case. CymaBay Therapeutics Inc (NASDAQ:CBAY) is the most popular stock in this table. On the other hand Mercantile Bank Corp. (NASDAQ:MBWM) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks One Liberty Properties, Inc. (NYSE:OLP) is even less popular than MBWM. Hedge funds dodged a bullet by taking a bearish stance towards OLP. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately OLP wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); OLP investors were disappointed as the stock returned 10.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.