Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in October due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 30 S&P 500 stocks among hedge funds at the end of September 2018 returned an average of 6.7% through November 15th whereas the S&P 500 Index ETF gained only 2.6% during the same period. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at One Liberty Properties, Inc. (NYSE:OLP) from the perspective of those elite funds.

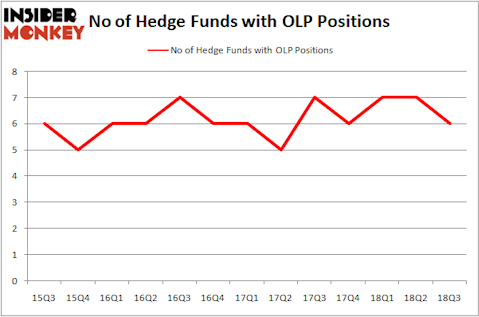

One Liberty Properties, Inc. (NYSE:OLP) has seen a decrease in enthusiasm from smart money of late. OLP was in 6 hedge funds’ portfolios at the end of September. There were 7 hedge funds in our database with OLP holdings at the end of the previous quarter. Our calculations also showed that OLP isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are viewed as slow, outdated financial vehicles of the past. While there are greater than 8,000 funds with their doors open at present, Our experts look at the aristocrats of this club, around 700 funds. These money managers watch over most of the hedge fund industry’s total capital, and by shadowing their inimitable equity investments, Insider Monkey has identified many investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a look at the recent hedge fund action encompassing One Liberty Properties, Inc. (NYSE:OLP).

What have hedge funds been doing with One Liberty Properties, Inc. (NYSE:OLP)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of -14% from one quarter earlier. On the other hand, there were a total of 6 hedge funds with a bullish position in OLP at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’s Renaissance Technologies has the number one position in One Liberty Properties, Inc. (NYSE:OLP), worth close to $22.3 million, accounting for less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is Millennium Management, led by Israel Englander, holding a $1.7 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors that hold long positions encompass John Overdeck and David Siegel’s Two Sigma Advisors, Thomas Bailard’s Bailard Inc and Ken Griffin’s Citadel Investment Group.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: D E Shaw. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 700+ hedge funds tracked by Insider Monkey identified OLP as a viable investment and initiated a position in the stock.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as One Liberty Properties, Inc. (NYSE:OLP) but similarly valued. We will take a look at TechTarget Inc (NASDAQ:TTGT), Foundation Building Materials, Inc. (NYSE:FBM), Ciner Resources LP (NYSE:CINR), and Civitas Solutions Inc (NYSE:CIVI). This group of stocks’ market values match OLP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TTGT | 15 | 87997 | 1 |

| FBM | 8 | 17215 | 0 |

| CINR | 2 | 8039 | 0 |

| CIVI | 12 | 55693 | 0 |

| Average | 9.25 | 42236 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.25 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $26 million in OLP’s case. TechTarget Inc (NASDAQ:TTGT) is the most popular stock in this table. On the other hand Ciner Resources LP (NYSE:CINR) is the least popular one with only 2 bullish hedge fund positions. One Liberty Properties, Inc. (NYSE:OLP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TTGT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.