A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on NVIDIA Corporation (NASDAQ:NVDA).

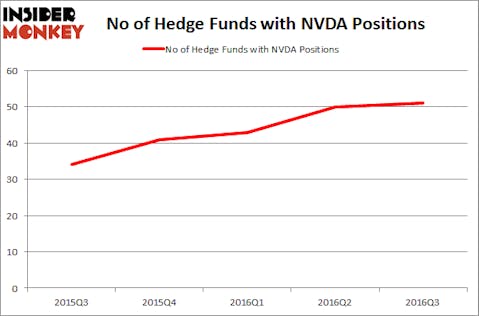

Is NVIDIA Corporation (NASDAQ:NVDA) ready to rally soon? Money managers are in a bullish mood. The number of bullish hedge fund bets rose by 1 recently. NVDA was in 51 hedge funds’ portfolios at the end of September. There were 50 hedge funds in our database with NVDA holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Spectra Energy Corp. (NYSE:SE), Southwest Airlines Co. (NYSE:LUV), and Baxter International Inc. (NYSE:BAX) to gather more data points.

Follow Nvidia Corp (NASDAQ:NVDA)

Follow Nvidia Corp (NASDAQ:NVDA)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

science photo/Shutterstock.com

With all of this in mind, let’s view the recent action regarding NVIDIA Corporation (NASDAQ:NVDA).

How are hedge funds trading NVIDIA Corporation (NASDAQ:NVDA)?

At Q3’s end, a total of 51 of the hedge funds tracked by Insider Monkey were long this stock, a change of 2% from the previous quarter. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the number one position in NVIDIA Corporation (NASDAQ:NVDA). Arrowstreet Capital has a $490.2 million position in the stock, comprising 1.6% of its 13F portfolio. On Arrowstreet Capital’s heels is Renaissance Technologies, managed by Jim Simons, which holds a $219.2 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism contain John Armitage’s Egerton Capital Limited, and Cliff Asness’ AQR Capital Management.

Consequently, key money managers were leading the bulls’ herd. Coatue Management, managed by Philippe Laffont, created the most valuable position in NVIDIA Corporation (NASDAQ:NVDA). Coatue Management had $136.9 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $74.2 million investment in the stock during the quarter. The other funds with new positions in the stock are David Halpert’s Prince Street Capital Management, Solomon Kumin’s Folger Hill Asset Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks similar to NVIDIA Corporation (NASDAQ:NVDA). These stocks are Spectra Energy Corp. (NYSE:SE), Southwest Airlines Co. (NYSE:LUV), Baxter International Inc. (NYSE:BAX), and China Unicom (Hong Kong) Limited (ADR) (NYSE:CHU). This group of stocks’ market caps are closest to NVDA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SE | 25 | 446491 | 11 |

| LUV | 53 | 2290720 | 8 |

| BAX | 50 | 4345509 | -4 |

| CHU | 12 | 39176 | 5 |

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $1.78 billion. That figure was $1.9 billion in NVDA’s case. Southwest Airlines Co. (NYSE:LUV) is the most popular stock in this table. On the other hand China Unicom (Hong Kong) Limited (ADR) (NYSE:CHU) is the least popular one with only 12 bullish hedge fund positions. NVIDIA Corporation (NASDAQ:NVDA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LUV might be a better candidate to consider a long position.