Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 20% in 2019 (through September 30th). Conversely, hedge funds’ 20 preferred S&P 500 stocks generated a return of 24% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ consensus stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like NMI Holdings Inc (NASDAQ:NMIH).

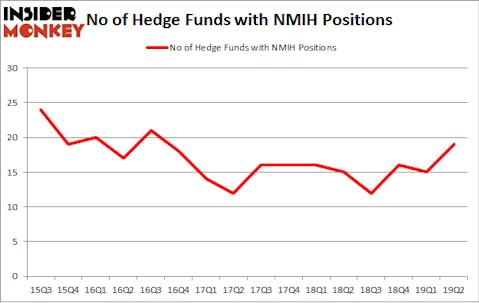

Is NMI Holdings Inc (NASDAQ:NMIH) the right pick for your portfolio? Hedge funds are getting more optimistic. The number of bullish hedge fund positions rose by 4 in recent months. Our calculations also showed that NMIH isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are many tools investors put to use to assess publicly traded companies. A duo of the most innovative tools are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the best money managers can outpace their index-focused peers by a healthy amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to review the latest hedge fund action encompassing NMI Holdings Inc (NASDAQ:NMIH).

Hedge fund activity in NMI Holdings Inc (NASDAQ:NMIH)

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 27% from the previous quarter. By comparison, 15 hedge funds held shares or bullish call options in NMIH a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Oaktree Capital Management, managed by Howard Marks, holds the most valuable position in NMI Holdings Inc (NASDAQ:NMIH). Oaktree Capital Management has a $141.3 million position in the stock, comprising 2.6% of its 13F portfolio. The second largest stake is held by Renaissance Technologies which holds a $49.4 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions include Richard Driehaus’s Driehaus Capital, Vivian Lau’s One Tusk Investment Partners and Israel Englander’s Millennium Management.

Consequently, key money managers have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the largest position in NMI Holdings Inc (NASDAQ:NMIH). Arrowstreet Capital had $2.3 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also initiated a $1.3 million position during the quarter. The other funds with brand new NMIH positions are Minhua Zhang’s Weld Capital Management, Bruce Kovner’s Caxton Associates LP, and Ken Griffin’s Citadel Investment Group.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as NMI Holdings Inc (NASDAQ:NMIH) but similarly valued. We will take a look at Allscripts Healthcare Solutions Inc (NASDAQ:MDRX), Alexander’s, Inc. (NYSE:ALX), Nevro Corp (NYSE:NVRO), and Jumia Technologies AG (NYSE:JMIA). This group of stocks’ market caps match NMIH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MDRX | 18 | 219405 | -3 |

| ALX | 4 | 72690 | 0 |

| NVRO | 28 | 549758 | -4 |

| JMIA | 8 | 8681 | 8 |

| Average | 14.5 | 212634 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $213 million. That figure was $230 million in NMIH’s case. Nevro Corp (NYSE:NVRO) is the most popular stock in this table. On the other hand Alexander’s, Inc. (NYSE:ALX) is the least popular one with only 4 bullish hedge fund positions. NMI Holdings Inc (NASDAQ:NMIH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately NMIH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on NMIH were disappointed as the stock returned -7.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.