Is Neogen Corporation (NASDAQ:NEOG) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

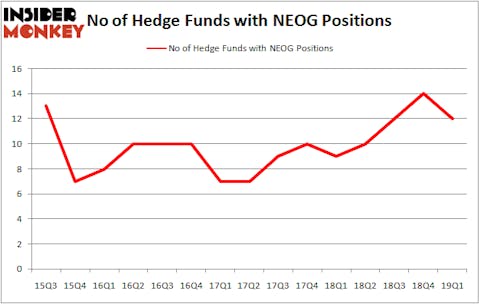

Is Neogen Corporation (NASDAQ:NEOG) a splendid stock to buy now? Money managers are becoming less hopeful. The number of long hedge fund positions went down by 2 lately. Our calculations also showed that NEOG isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a look at the recent hedge fund action surrounding Neogen Corporation (NASDAQ:NEOG).

What does smart money think about Neogen Corporation (NASDAQ:NEOG)?

At Q1’s end, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards NEOG over the last 15 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

The largest stake in Neogen Corporation (NASDAQ:NEOG) was held by D E Shaw, which reported holding $11.4 million worth of stock at the end of March. It was followed by Marshall Wace LLP with a $10.3 million position. Other investors bullish on the company included Citadel Investment Group, Royce & Associates, and AQR Capital Management.

Due to the fact that Neogen Corporation (NASDAQ:NEOG) has experienced falling interest from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of fund managers that elected to cut their entire stakes in the third quarter. Intriguingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the biggest investment of all the hedgies monitored by Insider Monkey, totaling close to $2.7 million in stock. Jim Simons’s fund, Renaissance Technologies, also said goodbye to its stock, about $1.7 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 2 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to Neogen Corporation (NASDAQ:NEOG). We will take a look at Corelogic Inc (NYSE:CLGX), J&J Snack Foods Corp. (NASDAQ:JJSF), Global Blood Therapeutics Inc (NASDAQ:GBT), and Cedar Fair, L.P. (NYSE:FUN). This group of stocks’ market caps are closest to NEOG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CLGX | 17 | 310733 | -2 |

| JJSF | 14 | 95789 | 4 |

| GBT | 26 | 730224 | 1 |

| FUN | 8 | 56848 | -2 |

| Average | 16.25 | 298399 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $298 million. That figure was $33 million in NEOG’s case. Global Blood Therapeutics Inc (NASDAQ:GBT) is the most popular stock in this table. On the other hand Cedar Fair, L.P. (NYSE:FUN) is the least popular one with only 8 bullish hedge fund positions. Neogen Corporation (NASDAQ:NEOG) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on NEOG as the stock returned 9.8% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.