Is Neenah, Inc. (NYSE:NP) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

Neenah, Inc. (NYSE:NP) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 7 hedge funds’ portfolios at the end of June. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Radius Health Inc (NASDAQ:RDUS), Patrick Industries, Inc. (NASDAQ:PATK), and Wesco Aircraft Holdings Inc (NYSE:WAIR) to gather more data points. Our calculations also showed that NP isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most traders, hedge funds are seen as unimportant, outdated financial tools of yesteryear. While there are more than 8000 funds with their doors open at present, Our researchers hone in on the masters of this club, approximately 750 funds. Most estimates calculate that this group of people handle bulk of the hedge fund industry’s total capital, and by keeping track of their best picks, Insider Monkey has revealed numerous investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a peek at the fresh hedge fund action regarding Neenah, Inc. (NYSE:NP).

What have hedge funds been doing with Neenah, Inc. (NYSE:NP)?

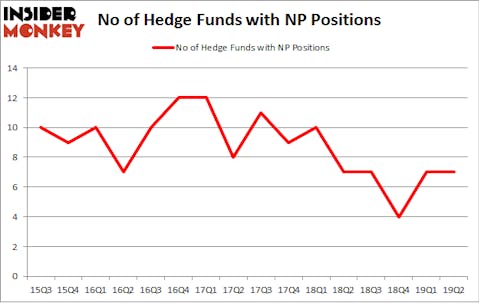

Heading into the third quarter of 2019, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in NP over the last 16 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of Neenah, Inc. (NYSE:NP), with a stake worth $3.6 million reported as of the end of March. Trailing Citadel Investment Group was Royce & Associates, which amassed a stake valued at $3.3 million. Millennium Management, Winton Capital Management, and Laurion Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Neenah, Inc. (NYSE:NP) has experienced bearish sentiment from the smart money, we can see that there is a sect of hedgies that elected to cut their entire stakes last quarter. Interestingly, Matthew Hulsizer’s PEAK6 Capital Management dropped the largest stake of all the hedgies watched by Insider Monkey, comprising about $0.5 million in stock, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital was right behind this move, as the fund sold off about $0.2 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Neenah, Inc. (NYSE:NP). We will take a look at Radius Health Inc (NASDAQ:RDUS), Patrick Industries, Inc. (NASDAQ:PATK), Wesco Aircraft Holdings Inc (NYSE:WAIR), and Boise Cascade Company (NYSE:BCC). All of these stocks’ market caps resemble NP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RDUS | 16 | 327584 | -6 |

| PATK | 15 | 86609 | -2 |

| WAIR | 21 | 252203 | -1 |

| BCC | 11 | 50811 | -2 |

| Average | 15.75 | 179302 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $179 million. That figure was $11 million in NP’s case. Wesco Aircraft Holdings Inc (NYSE:WAIR) is the most popular stock in this table. On the other hand Boise Cascade Company (NYSE:BCC) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Neenah, Inc. (NYSE:NP) is even less popular than BCC. Hedge funds dodged a bullet by taking a bearish stance towards NP. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately NP wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); NP investors were disappointed as the stock returned -2.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.