The fourth quarter was a rough one for most investors, as fears of a rising interest rate environment in the U.S, a trade war with China, and a more or less stagnant Europe, weighed heavily on the minds of investors. Both the S&P 500 and Russell 2000 sank as a result, with the Russell 2000, which is composed of smaller companies, being hit especially hard. This was primarily due to hedge funds, which are big supporters of small-cap stocks, pulling some of their capital out of the volatile markets during this time. Let’s look at how this market volatility affected the sentiment of hedge funds towards Mueller Industries, Inc. (NYSE:MLI), and what that likely means for the prospects of the company and its stock.

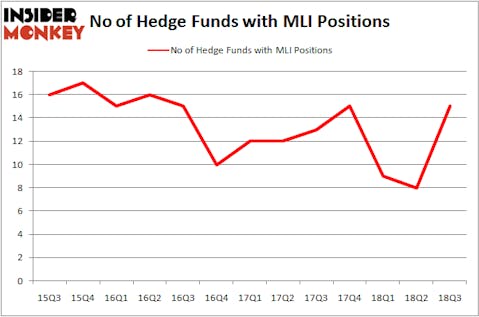

Mueller Industries, Inc. (NYSE:MLI) was in 15 hedge funds’ portfolios at the end of the third quarter of 2018. MLI has seen an increase in hedge fund interest recently. There were 8 hedge funds in our database with MLI holdings at the end of the previous quarter. Our calculations also showed that MLI isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a look at the recent hedge fund action encompassing Mueller Industries, Inc. (NYSE:MLI).

How are hedge funds trading Mueller Industries, Inc. (NYSE:MLI)?

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 88% from the second quarter of 2018. On the other hand, there were a total of 15 hedge funds with a bullish position in MLI at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Mueller Industries, Inc. (NYSE:MLI) was held by GAMCO Investors, which reported holding $125.3 million worth of stock at the end of September. It was followed by Fisher Asset Management with a $33.2 million position. Other investors bullish on the company included Royce & Associates, D E Shaw, and Citadel Investment Group.

As one would reasonably expect, specific money managers have jumped into Mueller Industries, Inc. (NYSE:MLI) headfirst. Millennium Management, managed by Israel Englander, initiated the most valuable position in Mueller Industries, Inc. (NYSE:MLI). Millennium Management had $2.6 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $1.1 million position during the quarter. The other funds with new positions in the stock are Joel Greenblatt’s Gotham Asset Management, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Mike Vranos’s Ellington.

Let’s now take a look at hedge fund activity in other stocks similar to Mueller Industries, Inc. (NYSE:MLI). We will take a look at Solid Biosciences Inc. (NASDAQ:SLDB), Tupperware Brands Corporation (NYSE:TUP), Constellium NV (NYSE:CSTM), and Enanta Pharmaceuticals Inc (NASDAQ:ENTA). This group of stocks’ market caps match MLI’s market cap.