The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 817 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30th, about a month before the elections. In this article we look at what those investors think of The Mosaic Company (NYSE:MOS).

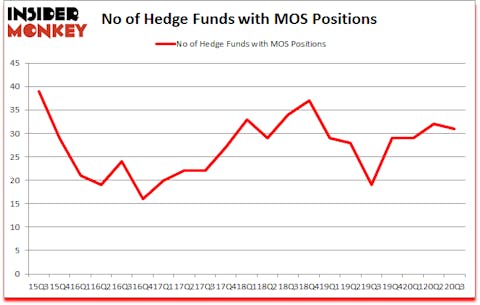

Is MOS a good stock to buy? Hedge funds were in a pessimistic mood. The number of long hedge fund bets retreated by 1 lately. The Mosaic Company (NYSE:MOS) was in 31 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistic is 39. Our calculations also showed that MOS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks). There were 32 hedge funds in our database with MOS positions at the end of the second quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most investors, hedge funds are assumed to be slow, outdated investment vehicles of yesteryear. While there are more than 8000 funds in operation at the moment, Our researchers choose to focus on the upper echelon of this club, about 850 funds. Most estimates calculate that this group of people have their hands on the lion’s share of the hedge fund industry’s total capital, and by tailing their matchless stock picks, Insider Monkey has discovered a few investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind we’re going to check out the fresh hedge fund action regarding The Mosaic Company (NYSE:MOS).

Do Hedge Funds Think MOS Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2020, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -3% from the second quarter of 2020. The graph below displays the number of hedge funds with bullish position in MOS over the last 21 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Adage Capital Management, managed by Phill Gross and Robert Atchinson, holds the most valuable position in The Mosaic Company (NYSE:MOS). Adage Capital Management has a $171.5 million position in the stock, comprising 0.4% of its 13F portfolio. On Adage Capital Management’s heels is David Greenspan of Slate Path Capital, with a $151.6 million position; 8.6% of its 13F portfolio is allocated to the company. Other members of the smart money with similar optimism encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, D. E. Shaw’s D E Shaw and Brian J. Higgins’s King Street Capital. In terms of the portfolio weights assigned to each position Slate Path Capital allocated the biggest weight to The Mosaic Company (NYSE:MOS), around 8.63% of its 13F portfolio. King Street Capital is also relatively very bullish on the stock, earmarking 5.11 percent of its 13F equity portfolio to MOS.

Due to the fact that The Mosaic Company (NYSE:MOS) has witnessed falling interest from the entirety of the hedge funds we track, logic holds that there were a few fund managers that slashed their entire stakes heading into Q4. Interestingly, Greg Poole’s Echo Street Capital Management sold off the biggest stake of the “upper crust” of funds tracked by Insider Monkey, comprising about $1.7 million in stock. Robert Vincent McHugh’s fund, Jade Capital Advisors, also sold off its stock, about $1.4 million worth. These transactions are intriguing to say the least, as total hedge fund interest fell by 1 funds heading into Q4.

Let’s also examine hedge fund activity in other stocks similar to The Mosaic Company (NYSE:MOS). We will take a look at Cabot Oil & Gas Corporation (NYSE:COG), Tandem Diabetes Care Inc (NASDAQ:TNDM), Morningstar, Inc. (NASDAQ:MORN), UGI Corp (NYSE:UGI), Vedanta Ltd (NYSE:VEDL), iRhythm Technologies, Inc. (NASDAQ:IRTC), and B2Gold Corp (NYSE:BTG). All of these stocks’ market caps match MOS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COG | 25 | 203223 | -6 |

| TNDM | 30 | 379857 | -2 |

| MORN | 21 | 376758 | 1 |

| UGI | 23 | 181941 | -3 |

| VEDL | 9 | 33062 | 0 |

| IRTC | 26 | 445527 | 5 |

| BTG | 17 | 583145 | -1 |

| Average | 21.6 | 314788 | -0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.6 hedge funds with bullish positions and the average amount invested in these stocks was $315 million. That figure was $714 million in MOS’s case. Tandem Diabetes Care Inc (NASDAQ:TNDM) is the most popular stock in this table. On the other hand Vedanta Ltd (NYSE:VEDL) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks The Mosaic Company (NYSE:MOS) is more popular among hedge funds. Our overall hedge fund sentiment score for MOS is 77.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 33.3% in 2020 through December 18th but still managed to beat the market by 16.4 percentage points. Hedge funds were also right about betting on MOS as the stock returned 28.3% since the end of September (through 12/18) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Mosaic Co (NYSE:MOS)

Follow Mosaic Co (NYSE:MOS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.