Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of MGP Ingredients Inc (NASDAQ:MGPI).

MGP Ingredients Inc (NASDAQ:MGPI) has experienced an increase in support from the world’s most elite money managers lately. Our calculations also showed that MGPI isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are plenty of signals market participants have at their disposal to evaluate publicly traded companies. A pair of the most under-the-radar signals are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the top hedge fund managers can beat the broader indices by a very impressive amount (see the details here).

We’re going to check out the key hedge fund action encompassing MGP Ingredients Inc (NASDAQ:MGPI).

What does smart money think about MGP Ingredients Inc (NASDAQ:MGPI)?

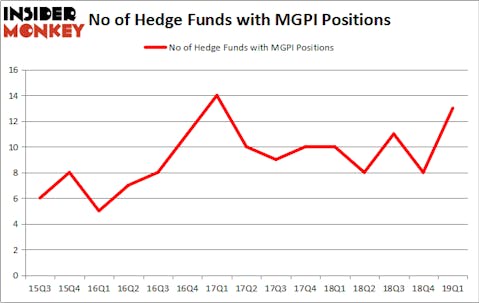

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 63% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MGPI over the last 15 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

The largest stake in MGP Ingredients Inc (NASDAQ:MGPI) was held by Cardinal Capital, which reported holding $16.1 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $1.9 million position. Other investors bullish on the company included PEAK6 Capital Management, Citadel Investment Group, and Marshall Wace LLP.

Consequently, key hedge funds were leading the bulls’ herd. PEAK6 Capital Management, managed by Matthew Hulsizer, initiated the biggest call position in MGP Ingredients Inc (NASDAQ:MGPI). PEAK6 Capital Management had $1.3 million invested in the company at the end of the quarter. Peter Algert and Kevin Coldiron’s Algert Coldiron Investors also initiated a $0.9 million position during the quarter. The other funds with brand new MGPI positions are Michael R. Weisberg’s Crestwood Capital Management, Dmitry Balyasny’s Balyasny Asset Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as MGP Ingredients Inc (NASDAQ:MGPI) but similarly valued. These stocks are Gulfport Energy Corporation (NASDAQ:GPOR), Cambrex Corporation (NYSE:CBM), Gibraltar Industries Inc (NASDAQ:ROCK), and Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA). This group of stocks’ market caps are closest to MGPI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GPOR | 23 | 141764 | 1 |

| CBM | 13 | 33277 | 0 |

| ROCK | 14 | 96661 | 4 |

| LOMA | 7 | 17313 | 0 |

| Average | 14.25 | 72254 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $72 million. That figure was $24 million in MGPI’s case. Gulfport Energy Corporation (NASDAQ:GPOR) is the most popular stock in this table. On the other hand Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA) is the least popular one with only 7 bullish hedge fund positions. MGP Ingredients Inc (NASDAQ:MGPI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately MGPI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); MGPI investors were disappointed as the stock returned -18.6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.